Each generation has its distinctive qualities, and Generation Z is no different. The youngest generation, Gen Z, is taking over as the oldest Gen Zers, who are roughly 25 years old, enter the workforce.

Their size and purchasing power are increasing, so it’s no surprise that marketers find this generation enticing. They are also becoming more ethnically diverse and may end up being the wealthiest.

Most importantly, Generation Z can become financially independent. Financial freedom refers to the capacity to fulfill your life goals due to stress-free money management. Gen Z representatives are actively taking payday loans online Canada during the early years of working for a living, saving money, and investing. Younger Canadians are eager to move forward despite the obstacles, be ready for anything, and create bright futures as our economy improves.

How Generation Z is Becoming Financially Independent

When it comes to money, Gen Z is a series of contrasts. The majority of them are off to a solid start, but some of them have financial knowledge gaps. A significant number of Gen Zers are aware that they need to learn more.

The more sophisticated and intricate investing techniques, however, terrify many people who understand the fundamentals. Finally, one of the most educated generations is Gen Z. Unfortunately, they must also make payments on substantial student loan debt to survive while they are in school.

Gen Z Has Begun to Invest Actively

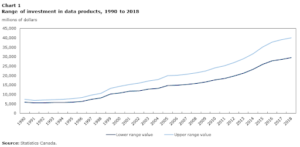

Canadians are active investors regardless of generation. For example, statistics show that more and more Canadians are investing in data products.

In their portfolios, Gen Zers tend to favor high-risk investments over traditional ones and are active investors. The best way to accumulate wealth and achieve financial independence is by investing. They are more exposed to digital assets like cryptocurrencies and NFTs and use alternative instruments (like trading apps).

During the pandemic, young investors showed a higher risk appetite, taking advantage of stimulus cheques, trading more frequently than investing, and supporting meme stocks (i.e., GameStop and AMC) on Reddit boards.

Self-Reward Initially

Zoomers must create a budget and analyze their financial flow. When they are young, most people prioritize their spending (holidays, social activities, and entertainment) before saving any money that may be left over.

That is a surefire strategy to ensure that your financial future is unstable. Therefore, turn this around and determine how much you must save to achieve your goals before making sure you pay yourself first. Spend the remaining funds after paying your bills and saving the necessary amount for your future.

Establish an Emergency Fund

To help them get through a worst-case financial scenario and keep them from sliding into debt, zoomers should establish an emergency fund that is at least three months’ worth of living expenses.

You can find yourself in a precarious situation if your automobile breaks down or you experience a medical emergency. If the money is left over, you might finally be able to save enough for a deposit or that year abroad you had your heart set on (while keeping that three-month buffer).

Keep your emergency fund in a savings account for convenient access even though interest rates are at historic lows.

Parents Can Close the Financial Literacy Gap

Parents can have a big impact on Gen Z youngsters who are younger by teaching them to sound financial practices. They can start earlier by reading age-appropriate literature or participating in enjoyable activities, which will fill the gap in financial education that is missing from the majority of high schools and colleges.

Generation Z will be unable to manage their finances effectively if they do not receive formal financial education and parental assistance. The majority of Gen Zers’ time is spent on social media, which influences this generation’s viewpoints.

In comparison to earlier generations, Gen Z learns differently. Along with their parents, YouTube and TikTok were the key sources of financial education for 38% of respondents, while 17% mentioned Twitter and Instagram among other social media platforms.

Don’t Follow Superficial Financial Advice

Rough financial decisions are virtually never a good idea. Before acting on any financial advice you receive from TikTok or another social media platform, make sure to back it up with research or the advice of a person you trust.

Don’t let the fear of missing out cause you to make speculative investments. These days, Reddit trends and cryptocurrencies are making a lot of news, but these are incredibly dangerous investment ideas that you should only think about if you are financially secure. Instead, exercise caution when making financial decisions and wait to invest until you have the fundamentals in place.

Debt Management

Being debt-free may be difficult, especially if you have a lot of student loan debt. But it’s important to keep your debt under control. The Generation Z generation is only starting to build up debt via credit card debt, student loans, and auto loans, among other sources.

For young folks, debt accumulates so quickly when they first get access to credit. When debt is not effectively managed, it can outpace savings, which can hurt your financial priorities and aspirations. Avoiding a debt spiral out of control is the best thing you can do.

Acquire Insurance

Zoomers should make use of their advanced age and good health to get the best insurance coverage at the lowest cost. In the event of unanticipated situations, life and critical sickness insurance might save your finances.

Gen Z needs to confront some difficult issues like what would happen if they got sick or got into an accident and couldn’t work. You won’t have to worry about the “what ifs” if you plan and prepare for the worst-case scenario.

Through insurance, you can safeguard your way of life and potential income. Many people wait until they are between 35 and 40 years old, or even until they are 50, to start preparing their protection.

Conclusion

Gen Z is exceptional in a variety of fields. They must continue to educate themselves to manage their finances. Self-education alone, though, is insufficient. Gen Zers who want to maximize their financial situation must also develop a sense of personal accountability and empowerment.

This is knowing how to live within your means, assessing your spending and saving behaviors, and making any necessary adjustments to place yourself on solid financial ground, even if it necessitates forgoing certain desires or deferring gratifying purchases.