Do you live in or around Orange County, California and need to know what your property’s worth? Are you an investor or homeowner who wants to be sure you’re getting the best return on your investment? Then check out this guide for property appraisers in Orange County, California. This article will give you all the information you need to know about how to become a property appraiser in Orange County, including requirements, education and experience requirements, and more.

How do I find out who owns a property in Florida?

Finding out who owns a property in Florida is simple. You can use the property appraiser website or app to search for information about the property and its owners.

Did the property taxes go up in Palm Beach County?

If you have recently moved to Palm Beach County, you may have noticed that the property taxes went up this year. Well, the increase is due to a 3% increase in the government’s general fund budget, which pays for all county services. In addition, there was a 1% increase in the local real estate transfer tax and a 0.5% increase in the school district tax.

While property taxes are always a source of contention, it is important to keep in mind that they are one of the main ways that Palm Beach County provides essential services like schools and roads. If you are thinking about selling your home or moving to Palm Beach County, be sure to ask your property appraiser how much your taxes will be this year.

Are appraisals public record Florida?

Yes, appraisals are public records in Florida.

How does Palm Beach County assess property value?

One of the most common questions property appraisers in Palm Beach County are asked is how they assess property value. In order to assess a property’s value, Palm Beach County relies on a number of factors, including market conditions and the physical condition of the property.

According to the Palm Beach County Appraisal District, an appraisal typically takes into account five factors when assessing a home’s worth:

-The location of the home in relation to other properties in its surrounding area

-The size and structure of the home

-The age and condition of the home

-The amenities and features of the home, such as appliances and furnishings

-Current market conditions

Are property deeds public record in Florida?

In Florida, property deeds are public record. This means that anyone can access them at the county courthouse. This information can be helpful if you’re looking to buy or sell a property in Orange County.

How do I do a property title search in Florida?

There are a few ways to do a property title search in Florida. You can either search the public records online, or you can go to the county courthouse and request a title search.

The public records online system typically has more up-to-date information than the county courthouse system, but it can take a longer time to get results. The county courthouse system is usually faster, but you may have to wait in line and pay for the service.

whichever option you choose, make sure to read the instructions carefully before you start your search.

Can assessor come on my property without permission in Florida?

In Florida, an assessor can come onto your property without any permission or notification if they are conducting an appraisal. This means that the assessor is legally allowed to look around and take pictures of your property in order to make an accurate assessment.

Do seniors in Florida pay property taxes over 65?

Senior citizens in Florida can pay property taxes over the age of 65. This is thanks to a law that was passed in 2008. The law ensures that seniors are treated the same as other residents when it comes to paying property taxes.

The law does have some restrictions, however. For example, seniors must be able to prove that they own the property and that they live there full time. They also cannot use the property as their main residence. Finally, the property must be worth at least $100,000.

If you are a senior citizen in Florida and you are interested in paying your property taxes over 65, please contact a property appraiser to get started. They will be able to help you figure out if the taxes are applicable to you and how much you will have to pay.

How is just value determined in Florida?

Just valuation is determined in Florida by multiplying the current market value (or assessed value) of the property by a percentage. The percentage can be based on a number of factors, including the location and size of the property, its age, and its condition.

Can Code Enforcement enter my property in Florida?

In Florida, property valuations are conducted by property appraisers. Property appraisers are licensed by the state and are responsible for performing property valuations in order to set the property tax rates in Orange County, Florida.

Property appraisers typically have the authority to enter your property in order to conduct a valuation. However, there are certain situations where an entry may not be warranted. For example, if you have locked the gate to your property, the appraiser may not be able to get inside. Additionally, if you believe that the appraiser is not qualified or is not conducting the valuation in an objective manner, you may want to speak with an attorney.

How many years is adverse possession in Florida?

If you are considering adverse possession in Florida, it is important to understand the timeline. In general, adverse possession in Florida lasts for as long as the possessor occupies the property without the owner’s consent and satisfies two requirements: (1) continuous possession for a period of at least six months and (2) exclusive use of the property for the benefit of the possessor. If any of these conditions is not met, then the period of adverse possession may be shorter.

Who can claim property based on adverse possession in Florida?

In Florida, adverse possession is a law that allows someone to claim property that they have been in physical possession of without legal title for a certain period of time. This can be beneficial to someone who owns property that they no longer want or need and is looking for a way to get rid of it without having to pay taxes on it or deal with any pesky legalities.

Adverse possession can be claimed by anyone who has been in physical possession of the property for at least six months and has not done anything that would show that they do not intend to continue to possess the property. This means that the person does not have to be the legal owner of the property in order to claim adverse possession; they just have to be in possession of it.

There are some exceptions to the rule of six months in physical possession, however. For example, if you were forced out of the property by someone else and did not have a chance to return before the six-month period was up, you would not be able to claim adverse possession.

Additionally, adverse possession cannot be used as a way to avoid paying taxes on the property. If you are claiming adverse possession based on this law, you must still pay any

palm beach county tax collector //

If you live or work in Palm Beach County, you need to be familiar with the property appraiser. This is a government employee who is responsible for setting values on all types of real estate in the county. They use a number of factors to come up with their determination, including location, size, and condition of the property.

While property appraisers are not always popular, they are important nonetheless. Their job is to ensure that everyone playing in the real estate market has an accurate understanding of what something is worth. If you have any questions about how this process works or what your rights and responsibilities are as a taxpayer, be sure to ask your local property appraiser.

palm beach county property appraiser search

If you’re looking for a Palm Beach County property appraiser, you’re in luck. There are many to choose from, and each has their own set of qualifications and experience.

One of the best ways to find an appraiser is to search online. You can use websites like PropertyAppraisers.com or AppraiserSearch.net to do a comprehensive search across all Palm Beach County property appraisers. This will give you a list of candidates who meet your specific needs and criteria.

Once you’ve narrowed down your choices, it’s important to interview them in person. Ask about their qualifications and experience, as well as how they would approach valuing your property. Be sure to ask about any fees they may charge – this will help you determine if they’re a good fit for your needs.

Finally, be sure to document your conversations with the appraisers – this will help ensure that you’re getting the best value for your money.

palm beach county public records

If you are looking for information on how to get a Palm Beach County Property Appraiser, then this blog is for you.

Palm Beach County is located in South Florida and is made up of over 100 municipalities. Property appraisal in Palm Beach County is handled by the Public Records Department. You can find their website at www.pbocounty.org/prd.

Property appraisers are appointed by the Board of County Commissioners and hold statewide certification as public records officers. A property appraiser’s job is to determine the market value of real estate in their county and provide this information to the public.

To become a property appraiser in Palm Beach County, you must have a degree in business, accounting, or law from an accredited college or university and pass a state certification exam. The minimum education requirement for becoming a property appraiser with Palm Beach County is a baccalaureate degree from an accredited college or university.

To be certified as a public records officer in Florida, you must have at least five years of experience as an assistant or deputy county recorder or property appraiser with experience rating at least 2,000 completed transactions per year.”

broward county property appraiser pay

The Broward County Property Appraiser’s Office is a vital part of the county government and its employees play an important role in helping to ensure that property values are accurately assessed and recorded.

Property appraisers are responsible for conducting a full inspection of a property, recording all relevant information about the property such as square footage, lot size, and type of property, and then issuing an assessment report which reflects the current market value of the property.

Property appraisers in Broward County receive a salary based on their level of experience and the amount of work they complete each month. The salary range for Broward County property appraisers is typically between $48,000 and $64,000 per year.

If you are looking to become a property appraiser in Broward County or any other Florida county, be sure to check out the job listings on Indeed.com.

palm beach county property appraiser

If you are looking for an experienced and knowledgeable property appraiser in Palm Beach County, Florida, then you have come to the right place. At The Appraisal Group, we offer a wide range of services that will help you get the best value for your property.

We are experts in the field of real estate appraisal, and our team of professionals is dedicated to providing the highest quality service possible. We have years of experience valuing properties in Palm Beach County, and our knowledge and expertise will help you get the most accurate value for your property.

Contact us today to schedule a consultation with one of our property appraisers in Palm Beach County. We would be happy to answer any questions that you may have about our services or about valuation in general.

palm beach county property tax records

Property appraisers play an important role in the of property valuation and taxation.

In order to provide accurate and up-to-date information on property appraisals, palm beach county has created its own property tax records website.

Property owners in palm beach county can find their assessments, valuations, comparisons to other properties and more on the palm beach county property tax records website.

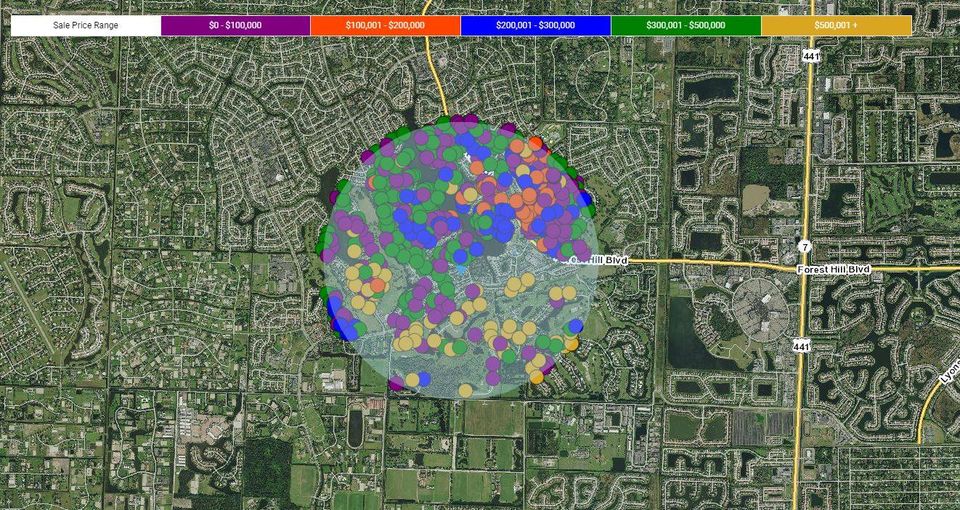

palm beach county property appraiser map

Palm Beach County Property Appraiser Map

If you own or are interested in purchasing property in Palm Beach County, Florida, you’ll want to be sure to check out the property appraiser map! This map provides a detailed overview of all the different appraisers that work within the county, as well as their contact information.

This information is essential if you’re looking to buy or sell property in Palm Beach County – not to mention, it’s just really cool to have access to!

martin county property appraiser

If you are looking for an experienced property appraiser in Martin County, then it is important to contact the professionals at the Martin County Appraisal District. The district is a full-service appraisal and real estate firm that provides valuable services to the community.

The Martin County Appraisal District was founded in 1978 and since then, it has become one of the most respected appraisal firms in the area. Throughout its history, the district has remained committed to providing quality services to the community. This dedication is evident in the team’s commitment to education and training.

The district offers a wide range of appraisal services, including:

The Martin County Appraisal District is dedicated to ensuring that all of its clients receive top-quality service. If you are interested in learning more about the district or any of its appraisal services, please visit its website or contact us today.