If you’re looking to invest in property, you’ll need to know about the yield formula. The yield formula is a guideline used by property investors to calculate the potential return on their investments. In this full guide, we’ll explain everything you need to know about the yield formula – from what it is to how it works. So whether you’re thinking of buying an investment property or just curious about what all the fuss is about, read on!

What is the formula of current yield on bond?

There is no one-size-fits-all answer when it comes to figuring out the current yield on a bond, as this amount will vary depending on the specific bond’s original issue price, term, and any applicable coupons or yields. However, one common formula used to determine a bond’s current yield is Y = (1 – μ) * P, where Y is the current yield, μ is the default risk level (a measure of how much default risk is associated with a bond), and P is the bond’s original issue price.

What is current yield and YTM?

Current yield is the annualized yield of a security over a given period of time, typically one year. Yield to maturity (YTM) is the percentage of a security’s original purchase price that has been returned as dividends or capital gains after deducting the cost of the security.

What is current yield ratio?

The current yield ratio, also known as the gross margin or operating margin, is a key performance indicator used by business owners and investors to measure a company’s profitability. It is simply calculated as the percentage of revenue generated by a company’s operations over its total revenue.

The current yield ratio can be valuable in determining a company’s overall health and profitability. Generally speaking, a high current yield ratio indicates strong profitability while a low current yield ratio indicates weaker profitability. It can also be helpful in identifying opportunities for growth and improvement.

Is current yield equal to YTM?

The answer to this question is a bit complicated, but thankfully there is an easy way to calculate it.

Current yield is calculated by taking the gross yield (Gross before tax) and dividing it by the initial investment.

To use an example, assume you have $10,000 invested in a bond that pays 4% interest per year. The gross yield would be $400 per year and the current yield would be $40 per year (4% / $10,000).

How do I calculate current yield in Excel?

There are a few ways to calculate current yield in Excel. The easiest way is to use the formula CURRENTYIELD=YR/2, where YR is the year you want to calculate the yield for. If you have data from multiple years, you can use the CURRENTYIELD function to combine the data into one column.

The other way to calculate current yield is to use the YIELD() function. This function returns the annualized percentage return for a particular investment over a given period of time. To use this function, you first need to define the investment period (in years), and then specify the interest rate you want to use.

Both methods will give you the same results, but the CURRENTYIELD function is easier to understand and use.

Is current yield the same as interest rate?

The answer to this question is somewhat complex, but can be summarized in a few simple points.

First of all, it’s important to understand that the two terms are not always interchangeable. For example, if a bank offers a 3% APY on its savings account, that means the bank is paying you 3% per year on your deposited money. However, if you want to borrow money from the bank and are given an APR (annual percentage rate) of 14%, that means the bank will charge you 14% on every dollar you borrow for a period of one year.

Similarly, current yield refers to what you earn on an investment over a specific period of time, while interest rate refers to the rate at which banks are willing to lend money out (typically expressed as an annual percentage). So while current yield is closely related to interest rate, it’s not always interchangeable.

Can current yield be greater than YTM?

Yes, the current yield can be greater than the YTM. This occurs when the company’s growth rate outpaces the average rate of inflation. When this occurs, the company’s earnings are higher than what would be predicted based off of its past performance and its YTM.

Is current yield the same as coupon rate?

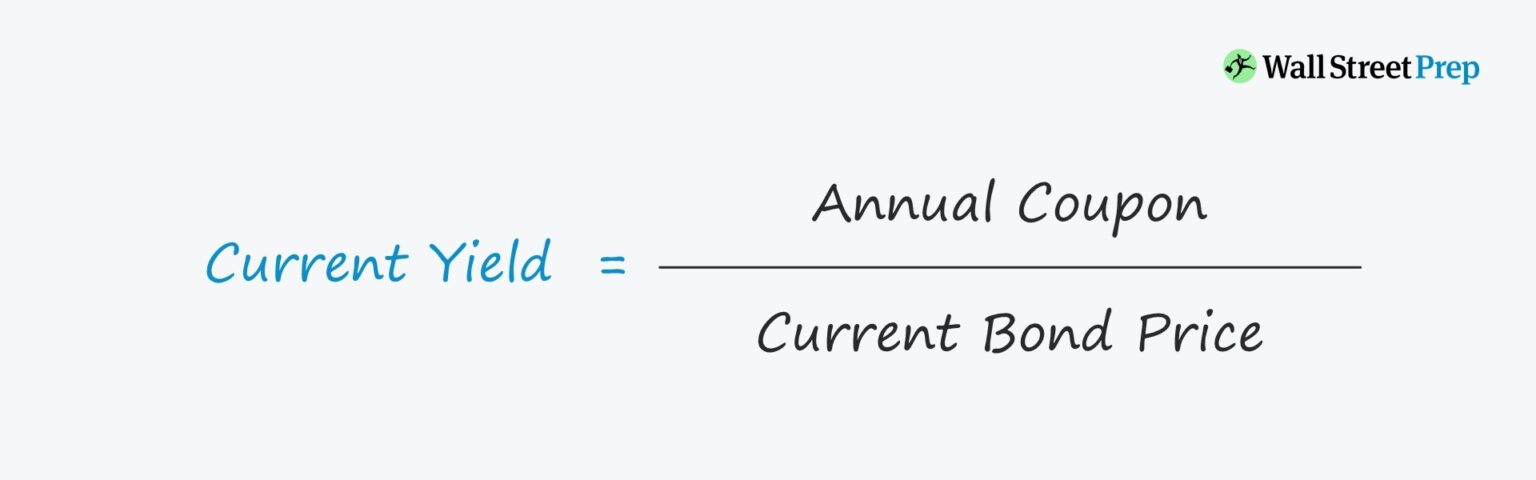

The current yield on a bond is calculated by dividing the coupon rate by the price of the bond.