Are you considering opening a Roth IRA account? The good news is, there are many options available to you. In this article, we’ll take a look at the Vanguard Roth IRA and see if it’s the best option for you.

How much does it cost to open a Vanguard Roth IRA?

A Vanguard Roth IRA account is one of the most popular choices among investors. That’s because it offers some great features and benefits, such as tax-free growth and low fees.

To open a Vanguard Roth IRA, you’ll need to pay a $20 initial investment, which will be deducted from your account balance. After that, there are no further charges or fees associated with the account, which makes it one of the most cost-effective Roth IRAs available.

Vanguard also offers a wide variety of investment options, so you can customize your Roth IRA to fit your portfolio needs. Plus, there’s no annual contribution limit, so you can invest as much money as you want into a Vanguard Roth IRA.

Is Vanguard free Roth IRA?

As a self-employed individual, you may have considered opening a Roth IRA with Vanguard. But are they really free? You might be surprised to learn that while Vanguard does offer a free Roth IRA option, there are other options that may be better for you.

Here’s a look at the pros and cons of opening a Roth IRA with Vanguard:

The Pros of Opening a Roth IRA with Vanguard:

1. Vanguard is one of the most trusted and respected names in retirement investing. Their products are known for their low fees and high returns.

2. The Vanguard Roth IRA offers some great features, including automatic contributions and access to an extensive selection of investment funds.

3. You can open a Roth IRA with Vanguard without having to pay any upfront fees. This is an advantage over many other Roth IRA providers, who often charge an annual fee.

4. In addition, Vanguard offers helpful resources and support, including phone consultations and online tutorials. This means you’ll be able to get the most out of your account no matter what your experience level is.

5. Finally, if you need to make any changes or updates to your account, Vanguard is always happy to help!

The Cons of Opening a

How does Vanguard Roth IRA work?

A Vanguard Roth IRA is a type of retirement account that allows individuals to invest money in a variety of different funds, with the potential to earn higher returns than traditional 401(k)s.

One key benefit of a Vanguard Roth IRA is that contributions are made on a pre-tax basis, which means that you will not have to pay taxes on the earnings when you withdraw the money in retirement. Additionally, as long as your investment earnings remain within the account throughout the year, you can take withdrawals tax-free at any time.

If you’re interested in opening a Vanguard Roth IRA, be sure to speak with your financial advisor to learn more about the account and its benefits.

What is the downside of a Roth IRA?

There are a few potential downsides to consider when choosing a Roth IRA over other types of IRAs.

The biggest drawback is that Roth IRAs offer no contribution room for future growth, which can make them less flexible and potentially less valuable down the line. Additionally, the withdrawal rules for Roth IRA accounts are generally more strict than those for traditional IRAs, so you may not be able to take out money tax-free if you need it in a hurry. Finally, Roth contributions are often considered higher-risk investments, as they don’t have the built-in guarantee of tax-deferred growth that traditional IRAs provide.

At what age does a Roth IRA not make sense?

The Roth IRA is a great retirement savings vehicle, but it’s not for everyone. Here are four reasons why you may not want to contribute to a Roth IRA:

1. You’re under age 50: If you’re under age 50, your contributions will be taxed at your marginal rate, which can be as high as 39.6%. This means that, on top of the income taxes you already pay, you could end up paying an extra $3,900 in taxes on your Roth IRA contribution! If you’re over age 50, your contributions are tax-free.

2. You have other savings goals: If your priority is saving for retirement rather than investing for other purposes, a Roth IRA may not be the best option for you. A Roth IRA allows you to invest money tax-free and defer income tax payments until you take the money out in retirement. However, if your other savings goalsinclude investing for retirement and/or having more flexibility with how and when you take distributions, a Roth IRA may be a better choice.

3. You don’t plan to retire soon: If you don’t plan on retiring soon, contributing to a Roth

What is the 5 year rule for Roth IRA?

If you are age 59 1/2 or over, you may be able to open a Roth IRA even if you are not covered by an employer sponsored retirement plan. The so-called 5 year rule allows you to contribute up to $5,500 a year ($6,500 if you are 50 or over) in addition to what you may already be contributing to your Traditional or Employer Sponsored Retirement Plan.

The contribution limits for a Roth IRA are after-tax dollars, which means that any income or capital gains that you earn while the account is open will be included in the contribution amount. Furthermore, there is no maximum contribution limit for a Roth IRA. You can keep contributing as long as you want and the account will continue to grow tax deferred.

What is better a 401k or a Roth IRA?

A Roth IRA is a great option for people who want to save for retirement, but many people are unclear about which Roth IRA is the best for them.

A 401k is a good option if you are comfortable with the idea of investing your money with your employer. A 401k allows your employer to invest your money for you, and you can access it just like any other account at any time.

A Roth IRA is different than a 401k in two important ways. First, you can contribute money to a Roth IRA at any time. Second, you don’t have to pay taxes on the money that you contributed to a Roth IRA until you withdraw it in retirement. This means that a Roth IRA is a much better option if you want to take advantage of tax breaks in retirement.

If you are still unsure which Roth IRA is the best for you, contact your financial advisor or consult with an online retirement calculator like www.retirementcalculator.net. They can help you figure out which Roth IRA will be the best fit for your individual situation.

Is a Roth IRA worth it?

There are a few things to consider when deciding whether or not a Roth IRA is right for you. First, let’s consider the pros and cons of each option:

Pros of a Roth IRA:

1) You can contribute up to $5,500 per year ($6,000 if you’re 50 or over) without paying income tax on the money you save. This is a huge advantage compared to traditional IRAs, which limit contributions based on your income.

2) The money you save in a Roth IRA grows tax-free until you withdraw it. This is different from traditional IRAs, where your contributions are taxed upfront and then any growth in your account is taxed again when you take the money out.

3) If you need to withdraw money from your Roth IRA in order to cover immediate expenses like rent, groceries, or car repairs, there are no penalties or taxes imposed. This is unlike traditional IRAs, where any withdrawals made before age 59 ½ are subject to a 10% tax penalty and 20% tax on the remaining amount.

4) You can use a Roth IRA as part of estate planning. This means that if you die with money saved in a Roth IRA, your loved ones

How much does a Roth IRA grow?

A Roth IRA is a type of individual retirement account that offers investors several advantages over traditional Individual Retirement Accounts (IRAs). One big advantage of a Roth IRA is that withdrawals are not subject to income or estate taxes.

Roth IRAs are also advantageous because the money you contribute can grow tax-free, even if you don’t use it all in your lifetime. For example, if you contribute $5,000 to a Roth IRA this year and never touch it again, the money will continue to grow tax-free and be available when you retire. If you contributed the same amount to a traditional IRA, the $5,000 would only be available when you withdrew it during your retirement years.

However, not every person is eligible to open a Roth IRA. You must meet certain income requirements and have earned enough money to cover any applicable taxes on your contributions.

What should I put my Roth IRA into?

When it comes to Roth IRAs, the options are endless. What’s the best Roth for you?

Let’s take a closer look at what kind of returns you can expect from each Roth IRA option, and see which one might be best for you.

Roth IRA Returns: Allocations

There are a few things you need to consider when determining your Roth IRA allocation. The first is how much money you’ll need to save up in order to contribute, as well as how long you want to leave your money invested.

The second is what type of return you’re looking for. You have three options when it comes to Roth IRA returns: safe, moderate or high.

Here’s a breakdown of each:

Safe: Safe Roth IRA returns come with decent annual compounded returns of around 7%. This option is good if you want to stick your money in a low-risk investment that will grow over time.

Moderate: Moderate Roth IRA returns come with average annual compounded returns of around 10%. This option is good if you want some guaranteed growth, but aren’t overly concerned about risk.

High: High Roth IRA returns come with high annual compounded returns

Is Vanguard good for beginners?

Looking for a Roth IRA that’s accessible and beginner friendly? Vanguard might be the perfect option for you.

Vanguard is a well-known and popular Roth IRA provider, and they have several great features that could make it an ideal choice for you. First of all, Vanguard offers automatic enrollment, which means you can contribute money without even thinking about it. Additionally, Vanguard offers low fees and utilizes an industry-leading algorithm to invest your money. Finally, Vanguard offers a wide range of investment options, so you’re sure to find the right one for your needs.

If you’re ready to start saving for your future, Vanguard may be the right Roth IRA provider for you!

What should be in a Vanguard Roth IRA?

If you are thinking about contributing to a Roth IRA, Vanguard should be at the top of your list. Vanguard is known for its excellence in investments and for its low-cost options.

Vanguard has several different Roth IRA options that would be perfect for various investors. One option is the Vanguard Roth IRA with Employer Matching. This option allows you to contribute up to $18,000 ($24,000 if you are age 50 or older), and your employer will match your contribution up to 3%. This means that your total contribution is effectively $36,000.

Another great option is the Vanguard Roth IRA with Automatic Investing. This option allows you to invest your money automatically, without having to make any decisions. Your investment options include stocks, mutual funds, and ETFs.

If you are not sure what kind of Roth IRA option is best for you, Vanguard has a great guide on their website that can help guide you through the decision process.

Vanguard Roth IRA Fees

If you are considering opening a Roth IRA with Vanguard, be aware of the fees associated with this account type.

The primary fee charged by Vanguard is a $25 initial account setup fee. Once your account is open, there is a 0.30% annual fee on all balances in the account.

However, there are some other fees that you should be aware of as well. For example, if you withdraw money from your Roth IRA before the age of 59 ½, you will be subject to a 10% penalty. Additionally, if you take money out of your Roth IRA for any reason other than retirement, you will be subject to a 50% penalty.

vanguard roth ira minimum

A Vanguard Roth IRA has a number of advantages that can make it the right Roth IRA option for you.

One of the key benefits of a Vanguard Roth IRA is that contributions are not limited to $5,000 per year. This means that you can make as much money as you want to put into your account each year, without worrying about hitting any income limits.

Another great advantage of a Vanguard Roth IRA is that you can withdraw your contributions at any time without penalty. This means that you can easily access your money when you need it, and never have to worry about losing anything due to penalties or taxes.

Overall, a Vanguard Roth IRA is an excellent option for anyone looking for a high-quality Roth IRA with many options for customization.

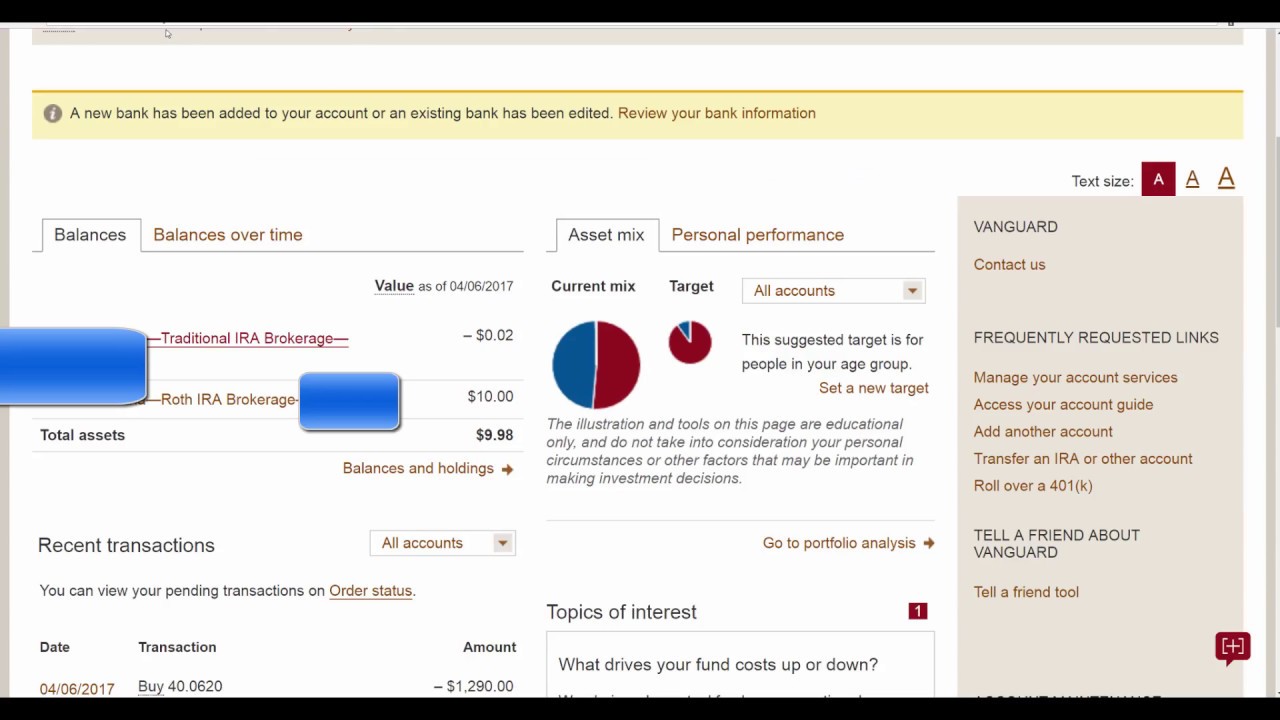

vanguard roth ira login

If you’re thinking about opening a Roth IRA, Vanguard may be a good option.

Vanguard offers a variety of Roth IRA options, including an automatically- contribution plan and a self-directed Roth IRA.

The self-directed Roth IRA is the best option for people who want to invest in their own retirement account. With this type of account, you have more control over your investment choices and can choose which investments to make.

Additionally, Vanguard offers a great selection of mutual funds that can be used in a Roth IRA.

vanguard roth ira calculator

Anyone who is thinking about opening a Roth IRA should definitely read this Vanguard article. The calculator provides an easy way to see if a Roth IRA is the best option for you based on your current income and assets. The calculator also includes information about contribution limits, so you can be sure to stay within those parameters.

If you’re not sure whether or not a Roth IRA is right for you, reading this Vanguard article is the perfect first step.

vanguard roth ira reddit

If you’re considering a Roth IRA, the Vanguard Roth IRA might be a great option for you. Here’s what you need to know about this type of account.

The Vanguard Roth IRA is one of the most popular options for Roth IRAs. It has low fees and offers many features that make it a great choice for people who want to save money on taxes. Here are some of the things that make the Vanguard Roth IRA such a good option:

-The account has low fees, which can help you save money on your taxes.

-The account has a wide variety of investment options, which means you can choose the right option for your needs.

-The account offers diversification benefits, which can help protect your money from risk.

-The account has a long history of being reliable and safe, so you can feel confident in investing your money in it.

vanguard roth ira investment options

If you’re looking for a Roth IRA investment option, the Vanguard Roth IRA may be an ideal fit. The Vanguard Roth IRA offers a number of advantages that could make it a better choice than other Roth IRA options.

One advantage of the Vanguard Roth IRA is that it has low fees. In comparison, some other Roth IRA options have fees that can amount to as much as 1% of your account balance. This could be a significant expense if you have a large Roth IRA account.

Another advantage of the Vanguard Roth IRA is that it offers unique investment options. For example, the Vanguard Roth IRA allows you to invest in stocks, ETFs, and bonds. This flexibility can give you more options when choosing an investment portfolio.

Overall, the Vanguard Roth IRA offers a number of advantages that could make it a better choice than other Roth IRA options. If you’re interested in learning more about this option, read our full article on the topic.

vanguard roth ira funds

There are many different Roth IRA funds on the market, but which is the best option for you?

The Vanguard Roth IRA fund was created in 1976 and it has been one of the most popular Roth IRA funds ever since. The Vanguard Roth IRA offers high-quality investment options with low fees. In addition, this fund has been consistently ranked as one of the best Roth IRA funds for both income and growth.

If you are looking for a Roth IRA fund that offers high-quality investment options and low fees, the Vanguard Roth IRA fund is a great option.

fidelity vs vanguard roth ira

When it comes to Roth IRAs, there are a lot of options out there.

One of the most popular Roth IRA options is the Vanguard Roth IRA.

So, which one is the best for you?

Here’s a look at the differences between these two options and which may be better for you.

Fidelity Roth IRA: Fidelity offers a wide range of investment choices, including stocks, bonds, and mutual funds. They also offer more flexibility than Vanguard when it comes to contributing amounts and selecting account values.

Vanguard Roth IRA: Vanguard’s Roth IRA options are limited to Vanguard mutual funds. This means that you can’t choose among different types of stocks or bonds when contributing to a Vanguard Roth IRA. Additionally, Vanguard only allows contributions up to $5,500 per year, which is less than Fidelity’s limit of $17,500 per year.

is vanguard roth ira good

For those who are considering opening a Roth IRA, the Vanguard Roth IRA might be a good option. Here’s everything you need to know about this particular Roth IRA account:

1. The Vanguard Roth IRA is a low-cost option.

Unlike other Roth IRA options, the Vanguard Roth IRA charges no fees whatsoever. This makes it a great choice for budget-minded investors.

2. The Vanguard Roth IRA offers a high amount of flexibility.

The Vanguard Roth IRA allows you to make unlimited contributions, so you can customize your investment strategy based on your own needs and preferences. This degree of flexibility is rare in Roth IRAs, and makes the Vanguard Roth IRA an excellent choice for investors who want to get creative with their investing strategies.

3. The Vanguard Roth IRA provides ample opportunities for growth.

Vanguard offers both conservative and aggressive investment options in its Roth IRAs, so you’re sure to find an investment that fits your risk tolerance and investment goals. As a result, the Vanguard Roth IRA has the potential to provide substantial growth over time – which is something that many people appreciate in an retirement account.

best vanguard roth ira mutual funds

When it comes to Roth IRAs, Vanguard is a powerhouse.

Their funds are consistently rated as the best in the industry, and they offer a number of different options to fit every budget.

Here’s a look at some of their top Roth IRA options:

The Vanguard 500 Index Fund (VFINX)

The Vanguard Total Stock Market Index Fund (VTSMX)

The Vanguard Extended Market Index Fund (VGEMX)

The Vanguard Small-Cap Index Fund (VBRSAX)

Each of these funds offers low costs and broad exposure to the stock market. They also have low turnover rates, which means that your money will be more stable over time.

If you’re looking for a Roth IRA that offers a high level of customization, the Vanguard Roth IRA Options Fund (VROOX) is a great option. You can choose which stocks and ETFs to include in your portfolio, as well as how much money you want to invest each month. This fund also has one of the lowest expense ratios in the industry.

best vanguard roth ira index funds

There are many different Roth IRAs to choose from, but which one is the best for you? To help make your decision easier, we’ve compiled a list of the top Vanguard Roth IRA index funds.

Vanguard Total Stock Market Index Fund (VTSMX): This fund invests in stocks of large U.S. companies. It’s considered a conservative option because it tends to invest more in blue chip stocks than other funds. The fund has low fees and a reasonable expense ratio.

Vanguard Mega Cap Index Fund (VMANX): This fund invests in stocks of large U.S. companies that are considered mega caps. These are companies with a market capitalization of $10 billion or more. This fund has higher fees and a higher expense ratio than the Vanguard Total Stock Market Index Fund, but it also offers unique features, such as access to manager insights and specialized blend of stocks.

Vanguard REIT Index Fund (VNQI): This fund invests in securities of publicly traded real estate investment trusts (REITs). It’s an especially good choice if you’re interested in investing in real estate but don’t want to deal with the complexities and risks of owning individual properties. The fund

vanguard vs fidelity roth ira

When it comes to investing in a Roth IRA, Vanguard and Fidelity are two of the most popular options. So which one is the best for you?

Both Vanguard and Fidelity offer great Roth IRA options, but there are a few things to keep in mind when choosing which provider to go with. Here’s a breakdown of the key differences between the two providers.

Fidelity’s Roth IRA has some unique features, like its ability to automatically convert your contributions into growth investments. This can help you potentially earn more money over time, although it comes with risks.

Vanguard, on the other hand, offers greater investment flexibility and lower fees. You can also use Vanguard’s strategies to build a more diversified portfolio, which could provide you with superior long-term returns.

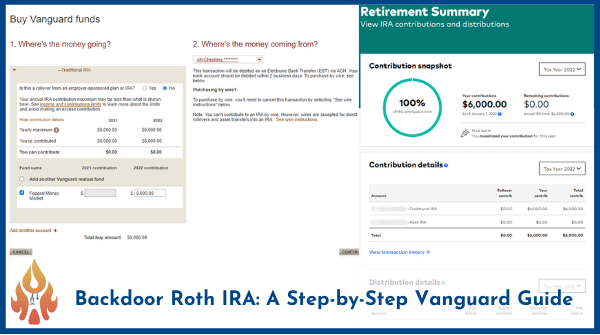

vanguard backdoor roth ira

Knowing what is in a Roth IRA can be confusing, particularly when there are so many options available. Vanguard has done its best to make the process as simple as possible with their backdoor Roth IRA.

What is a Vanguard Roth IRA?

A Vanguard Roth IRA is a type of individual retirement account that allows you to contribute money using after-tax dollars. This means that your contributions are not subject to federal income tax, which means that your savings will grow faster.

How does the backdoor Roth work?

The Vanguard backdoor Roth works like this: you make regular contributions to your Vanguard Roth IRA account, just like you would any other type of IRA account. However, once you have accumulated $5,000 in contributions, you can then transfer all of that money into a Vanguard Roth Ira with no additional taxes paid. This means that your money grows tax-free while it’s in the Vanguard Roth IRA!

Why should I consider a Vanguard backdoor Roth IRA?

There are several reasons why a backdoor Roth may be the right option for you. First and foremost, because these accounts are offered by such reputable financial institutions as Vanguard, there is an increased level of trustworthiness associated with them. Additionally

vanguard transfer roth ira

If you’re looking to create a Roth IRA, the Vanguard Roth IRA may be the best option for you. Here are four reasons why:

1. Low fees: Vanguard charges low fees for transferring money into and out of Roth IRAs, making it an affordable option.

2. Automatic contributions: If you have employer contributions withheld from your paycheck, Vanguard will automatically contribute the equivalent amount to your Roth IRA each month. This is great if you want to avoid having to manage your own account or track investment returns.

3. Wide range of investments: Vanguard offers a wide range of investment options in its Roth IRA funds, including stocks, bonds, and mutual funds. This gives you plenty of flexibility when deciding how to invest your money.

4. Easy access: You can easily access your Roth IRA funds anytime, anywhere through online tools and apps like Vanguard’s Investor Center. This makes it easy to make adjustments if necessary or take advantage of opportunities that may come up during the stock market volatility cycle.

vanguard convert to roth ira

Looking to invest in a Roth IRA but not sure which option is right for you? Check out our comprehensive guide to the Vanguard Roth IRA.

The Vanguard Roth IRA is a great choice for investors who want to maximize their tax-free growth potential. Here are four reasons why:

1. Low fees: Vanguard charges very low fees for managing your account, which makes it a great option for those who want to save money on their investment fees.

2. Automatic contributions: With the Vanguard Roth IRA, you don’t have to do any additional paperwork or take any extra steps to make contributions – the account will automatically contribute an annual amount equal to your income. This can help save you time and hassle!

3. Access to other Vanguard funds: The Vanguard Roth IRA allows you to invest in a variety of different funds, so you’re sure to find one that suits your specific investment goals and needs.

4. Tax-free growth: As long as your contributions are made over the course of the year, your funds grow tax-free – meaning that you’ll end up paying less in taxes when you withdraw them later on down the road!

vanguard contribute to roth ira

As an individual investor, one of the key decisions you have to make is whether or not to contribute money to a Roth IRA. And if you’re wondering which Roth IRA is the best for you, this Vanguard article will give you all the information you need.

In general, a Roth IRA is a great option for people who want to save money for retirement. Basically, when you contribute money to a Roth IRA, the IRS allows you to deduct the money you put in from your taxable income. This means that your Roth IRA contributions are effectively free money.

However, there are a few things to keep in mind before deciding whether or not a Roth IRA is right for you. First, make sure that your income falls within the limits specified by the IRS. Second, be sure that you have enough money saved up to cover the cost of taxes and fees associated with contributing to a Roth IRA. Finally, be sure that you’ll be able to take advantage of the tax breaks associated with a Roth IRA if you eventually decide to retire and start drawing on your assets.

So whatever your financial situation may be, it’s worth checking out a Roth IRA option before making any final decisions. The Vanguard article provides all the information you