Dollar General is a retail store chain with almost 20,000 stores across the United States. The company offers customers discounts on groceries and other items, as well as “payroll hours” which allows employees to earn money by working more than their usual 40 hours per week. Since the introduction of this program, several employee lawsuits have been filed alleging that Dollar General has violated minimum wage laws and other workplace regulations. In this blog post, we will provide you with the latest information about these lawsuits and what you can do if you’re an employee of Dollar General.

How do I check my paystub?

Pay stubs are a critical document for employers and employees. A pay stub should clearly list all earned wages, including hours worked, overtime pay, and any other monetary compensation earned during the month. Employers must keep accurate records of employee hours worked in order to ensure compliance with applicable labor laws.

There are a few basic steps you can take to check your pay stub:

1. Verify the date of the pay stub. The date is typically listed at the top or bottom of the document.

2. Compare the number of hours listed on your pay stub with what you reported working on your W-4 form. Make sure you enter all hours worked, including overtime and shift differential pay.

3. Check for errors or omissions on your pay stub. Make sure you include all wages earned (including tips), correct Social Security numbers for everyone listed on the pay stub, and correct addresses for everyone listed on the pay stub.

4. Review any deductions taken from your wages (such as taxes). Compare those figures with what is shown on your W-2 form to make sure they match up properly.

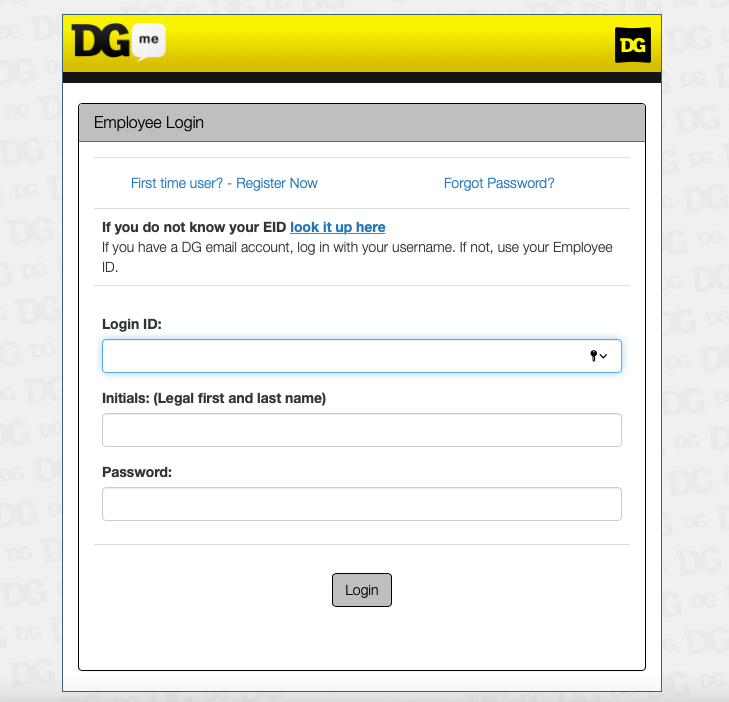

How do I access Dgme?

There are a few ways to access Dgme:

-You can log in to your account at dolargeneral.com.

-If you have an employee number, you can use the Employee Portal to log in and view your hours worked.

-If you don’t have an employee number, or if you want to view your hours for a different pay period, you can use the Payroll Hours Report.

How can I make my own pay stubs for free?

Making your own pay stubs is a great way to save money, and it’s free! Here’s how to do it:

1. Go to www.dollargeneral.com and sign in.

2. On the left panel, click “Employees & Departments.”

3. In the “Pay Stub” section, click the link for “Print Pay Stubs.”

4. You’ll be taken to a page where you can select the date range for your pay stubs, as well as the format (PDF or text). PDFs are easier to print out, but text versions are also available if you have a printer that can print text documents.

5. Click “Print” and then follow the instructions onscreen to make your pay stubs!

How do I get my pay stubs if I have direct deposit?

If you have direct deposit, your pay stubs will be automatically sent to you each week. If you do not have direct deposit, you will need to request them from your employer. You can obtain your pay stubs by visiting the Human Resources office or by calling the company’s toll-free number. You can also find information on how to get a pay stub on the company’s website.

Is there an app for view my paycheck?

There are a few different apps that allow you to view your paycheck. Each app has its own benefits and drawbacks. Here are three of the most popular apps:

1. PaycheckCruncher: This app is free and available on both Android and iPhone. It allows you to see your gross earnings, deductions, and taxes owed in real time. You can also save your paycheck for future viewing.

2. QuickBooks Online: This app is available on both desktop and mobile devices. It allows you to view your pay stubs, invoices, and other financial documents. You can also subscribe to premium services that give you access to account management features and more.

3. SalaryNow!: This app is free for employees with a corporate account and costs $4 per month for employees without a corporate account. SalaryNow! provides access to your entire pay history, as well as tools that help you manage your money and career growth opportunities.

Do Dollar General employees get a discount?

Dollar General is a budget-friendly option for employees who want to shop at the store but don’t want to sacrifice their paycheck. The company offers a number of benefits, including payroll hours, which can help employees save on their groceries.

To qualify for payroll hours, an employee must work at least 20 hours per week. Once they’ve met that requirement, they can start earning discounts off their grocery bill. The amount of the discount depends on how many hours the employee has worked in a given week. For example, an employee who works 40 hours will receive a 40% discount on their groceries.

The company also allows employees to use their paid time off entirely for shopping at Dollar General. This perk is especially valuable for those who have a lot of vacation time but don’t necessarily want to use it all up visiting family and friends. instead, they can put it towards groceries at the store.

In addition to offering discounts and paid time off, Dollar General also offers flexible scheduling options. Employees can choose whether or not they would like to work weekends or holidays; and if they do work them, they can choose when those days fall in the week. This gives employees some flexibility in terms of when they can spend time with family and friends while still keeping their job.”

What is CBL in Dollar General?

What is CBL?

CBL, or community benefit liability, is a requirement by Dollar General that its associates work a set number of hours each week. Associates are responsible for abiding by this requirement and must provide documentation to management if they work more than the required hours.

Why is CBL important to Dollar General?

The reason CBL is important to Dollar General is because it ensures that associates are productive and focused on their job duties. It also helps to keep the company organized and consistent with its standards. If an associate feels that they are not able to meet their CBL obligations, they may choose to leave the company.

What does YTD mean on a paycheck?

What does YTD mean on a paycheck?

Your weekly hours worked as an employee at Dollar General are counted in one year and are used to calculate your annual salary. Your yearly salary is then divided by 52 to get your hourly wage.

Can you make fake pay stubs?

If you’re looking to make some fake pay stubs, there are a few different ways that you can go about it. You could use a computer program like Adobe Photoshop or Microsoft Word to create fake pay stubs. You could also print out copies of real pay stubs and modify them using a word processor or graphics program. And finally, you could take pictures of yourself as if you were filling out a pay stub and use those images to create your own fake pay stubs.

How do I make a pay stub online?

Are you looking for an easy and convenient way to keep track of your payroll hours? If so, you may want to consider using a pay stub online. There are several websites that offer this service, and each has its own features and advantages. Here are some of the most popular pay stub websites:

Paychex: Paychex is one of the oldest and most well-known pay stub providers. It offers a variety of features, including automatic transmission of hours to your employer, direct deposit capabilities, and support for multiple jobs/ employers.

Paystubhub: Paystubhub is a newer site, but it has quickly gained popularity for its user-friendly interface and wide range of features. Some highlights include the ability to create custom pay stubs, export data to various formats, manage employee contributions/ deductions, and receive emails notifying you when there are changes to your payroll information.

PayPal: PayPal is one of the most popular payment platforms on the internet, so it should come as no surprise that it also offers users the option to create pay stubs. The process is simple – all you need is an email address and password for PayPal accounts.

Is a pay stub the same as a paycheck?

A pay stub is a document that employers issue to employees to record their wages and hours worked. A paycheck, on the other hand, is a document that employers issue to employees every week to reflect their earnings for the week. The main difference between a pay stub and a paycheck is that a pay stub typically includes only an employee’s gross wages, while a paycheck includes deductions for taxes and other benefits.

How do I get my pay stubs after termination?

If you have been terminated from your job at Dollar General, there are a few things you need to do in order to receive your paychecks. The first thing you will want to do is contact your human resources department and let them know that you have been terminated. Once they have received notification from you, they will need to send you a copy of your termination letter. Next, you will need to submit a W-4 form with your income information on it. This form can be found on the IRS website. Finally, you will need to file a statement of employment with the state unemployment office.

Do bank statements count as proof of income?

Yes, bank statements can be used as proof of income. However, it is important to keep in mind that not all banks will accept bank statements as proof of income. It is also important to keep in mind that bank statements do not always reflect actual earnings.

Is it illegal for a company to not give you a pay stub?

When you work for a company, you should be able to expect to receive a pay stub every week. This document will list your hours worked and the amount you earned. If you don’t receive a pay stub, or if it’s missing information, it may be illegal for your employer to not give you one.

If an employer fails to give their employees the required pay stubs, this could lead to some serious consequences. Not only can an employee sue their employer for unpaid wages, but they may also be ineligible for certain benefits such as unemployment insurance. If an employee does not receive their correct paychecks for long enough, they may even lose their jobs.

If you ever have questions about your pay or any other workplace issue, don’t hesitate to speak with your boss or HR representative. They will be able to help you understand your rights and what steps you can take if things go wrong.

What is paycheck app?

Looking for a way to keep track of your paycheck? Check out the latest app trend – paycheck apps! These apps allow you to view your earnings, deduct expenses, and even automatically deposit your checks. Here are a few options available:

1. Paycheck by direct deposit: One of the most popular options is paycheck by direct deposit. This app allows you to set up a direct deposit so that your earnings are automatically deposited into your bank account each week.

2. WageWorks: WageWorks is another popular option. This app allows you to view your earnings and expenses, as well as make deductions for taxes and retirement accounts. You can also set up automatic deposits for your checks each month.

3. QuickBooks Self-Employed: If you’re self-employed, check out QuickBooks Self-Employed. This app allows you to keep track of all of your income and expenses, as well as make deductions for taxes and retirement accounts. You can also set up automatic deposits for your checks each week.

What is payroll app?

Are you looking for an affordable, reliable payroll app? Check out Dollar General’s app! This app is perfect for small businesses who need to keep track of employee hours and payments. The app is easy to use and has all the features you’ll need to manage your payroll. Plus, it’s affordable, so you won’t have to break the bank to get a great payroll app. Give Dollar General’s app a try today!

How do I check my pay stub on ADP app?

If you have an account with ADP, the company’s payroll app is available to help you view your pay stubs. Once you’ve downloaded the app and logged in, you can find your pay stub under “My Pay Stubs.”

If you don’t have an account with ADP, or if you’re not sure how to access the app, contact the company for assistance. The payroll app is free to use.

Does Dollar General give yearly raises?

According to Glassdoor, Dollar General does give yearly raises. The average salary for a Dollar General associate is $13 per hour, which equates to roughly $28,000 per year. However, the pay varies greatly based on location and experience.

How much does a key holder at Dollar General make?

Dollar General, one of the largest discount department stores in the United States, has been in operation since 1962. The company currently employs more than 180,000 people and operates over 1,700 stores throughout the United States. According to recent reports, Dollar General’s average hourly wage is $8.81. This means that a key holder at Dollar General can expect to earn around $21,000 per year on average.

Is working at Dollar General easy?

It can be easy to work at Dollar General. In fact, according to Glassdoor, the average pay for a Dollar General store worker is $9 an hour. That’s not great, but it’s better than many other jobs out there. Plus, the hours are usually flexible and you can usually get your hours worked in as needed.

The downside is that the wages aren’t very high, and the hours are often long. It can be hard to find time for sick days or vacation days, and you may have to work nights or on weekends if you want a chance at advancement. Still, if you’re looking for a job that doesn’t require a lot of education or training and pays relatively well, working at a Dollar General may be perfect for you.

How often do you get pay stubs?

Dollar General pays its employees on a bi-weekly basis. The company encourages employees to arrive early for their shift in order to save time completing their paperwork and receive their paychecks more quickly.

How often are paycheck stubs provided?

If you’re like most Americans, you probably don’t keep track of how many hours you work each week. In fact, according to a recent study by the Pew Research Center, only about one-third of American workers record their hours worked each week on their pay stubs.

That’s why it can be helpful to see what other people are doing when it comes to tracking their work hours. That’s where payroll hour reviews come in.

A payroll hour review is simply a review of your pay stub that shows you how many hours you worked for each pay period and how much money you earned during that time period. This information can help you better understand your earnings and track your progress over time in relation to your goals.

There are a few things to keep in mind when completing a payroll hour review:

1. Make sure that all of the information on your pay stub is accurate. Mistakes can lead to inaccurate data and could impact your earning potential down the road.

2. Try to schedule a review at least once every six months so that any changes or updates to your work schedule will be reflected in your data.

3. Be sure to save all of yourpayroll hour reviews in a secure location so that you can easily access them if needed.

Why do you need pay stubs?

If you are an hourly employee at Dollar General, you may be wondering why you need to keep track of your payroll hours. The answer is that the company may require it in order to compensate you fairly for your time worked.

Dollar General requires that all employees submit a completed pay stub every week in order to receive their regular paychecks. If you do not submit a pay stub, or if it is incomplete, your salary may be reduced or withheld. In addition, if you leave Dollar General without good reason, your wages may also be reduced or withheld until your next payday.

Therefore, it is important to keep accurate records of your work hours and make sure that each paycheck reflects the actual amount of time that you worked. This will help ensure that you are being paid fairly for the work that you do and that you are not overworked or underpaid.