Inverse Head and Shoulders Pattern – full guide

A popular technical analysis indicator is the inverse head and shoulders pattern. This article will provide you with a full guide on how to identify this pattern and trade accordingly.

Is an inverse head and shoulder bullish?

An inverse head and shoulder pattern is considered to be a bullish signal. This occurs when the price of a security falls below its neckline and then rallies above it, forming an upside “H” shape. This suggests that buyers are overloading the market with supply, which should lead to increased prices.

Can a head and shoulders pattern reverse?

The head and shoulders pattern is one of the most commonly seen chart patterns and can be extremely powerful when used correctly. However, like with any other pattern, there are times when it can reverse. In this article, we will go over how to identify a reversal timeframe and how to position your assets accordingly.

When identifying whether or not a head and shoulders pattern has reversed, you need to look at the 1-month, 3-month, and 6-month charts. If the pattern has reversed on at least one of these charts, then it has likely reversed in the short-term. However, if the pattern hasn’t reversed on any of these charts, it might still continue to trend in a positive direction for some time longer.

After identifying that a head and shoulders pattern has reversed, you’ll want to start positioning your assets accordingly. The most important thing to do is stay liquid – meaning that you should be able to quickly sell your positions if they begin to lose value. Additionally, it’s best practice to stay away from highly risky investments such as stocks or commodities – instead focus on safer options such as bonds or yield stocks.

Is head and shoulders bullish or bearish?

Head and shoulders pattern is a technical analysis tool that is used to identify opportunities in the market. This pattern is formed when the prices of two assets move in opposite directions and it lasts for a period of time.

The pattern can be determined by analyzing the relative volumes of the two assets. When the head and shoulders pattern is present, it indicates that there is an opportunity for profits in the market. However, if this pattern is not present, then it could mean that there are concerns among investors and this could lead to a bearish outlook for the market.

How reliable is head and shoulders pattern?

The head and shoulders pattern is a well-known technical analysis indicator that is used to identify the potential for an uptrend or downtrend. The pattern consists of a series of higher highs and higher lows, which can be used to predict the direction of the stock market.

However, there is no single answer as to how reliable the head and shoulders pattern is. Some analysts believe that it can be quite accurate, while others believe that it is not as reliable as other indicators. Ultimately, it depends on the individual investor’s needs and preferences.

Which timeframe is best for head and shoulders pattern?

Understanding the head and shoulders pattern can be difficult for those not familiar with technical analysis. The general idea of the pattern is that prices for stocks, commodities, bonds, and other assets will rise and then decline in a symmetrical pattern. The timeframe over which this pattern typically occurs can be a major factor in timing your trades.

There are two primary timeframes for analyzing the head and shoulders pattern: short-term and long-term. The short-term timeframe is usually considered to span from 1 day to 3 months, while the long-term timeframe covers 4 quarters or 12 months.

Both timeframes offer opportunities to trade based on price movements. However, it is important to understand the different risks associated with each timeframe.

The short-term timeframe presents several risks that traders should be aware of. These risks include market manipulation, insider trading, and volatility swings.

The long-term timeframe offers a number of benefits that traders should consider when making decisions about trading. These benefits include improved accuracy in predicting price movements and reduced risk of loss due to market fluctuations.

What happens to a stock after a head and shoulders pattern?

A stock that has completed a head and shoulders pattern is often seen as a sign that it is overvalued. After the pattern is complete, the stock will likely fall in price.

How do you spot your head and shoulders?

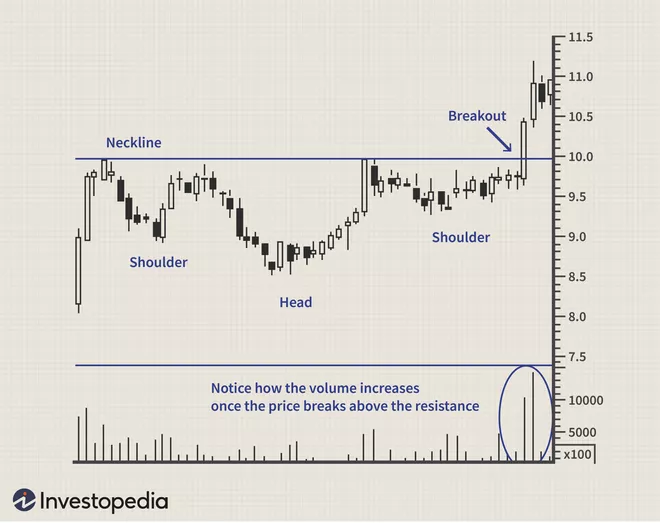

If you spot your head and shoulders pattern in the following chart, congratulations! This is a common technical trading indicator that can help you make better investment decisions.

The head and shoulders pattern is created when stock prices rise and then decline again. The pattern consists of two peaks and two valleys. The first peak is usually higher than the second peak, and the valleys are usually lower than the first peak.

To spot your head and shoulders pattern, you need to look for the following four indicators:

1) The height of the first peak

2) The width of the first peak

3) The height of the second peak

4) The width of the second peak

Is it better to buy at the resistance level?

When it comes to trading the inverse head and shoulders pattern (H&S), there is a lot of debate on whether or not it is better to buy at the resistance level or if you should wait for the price to break through.

The H&S pattern is one of the most popular reversal patterns and can provide valuable insight into the future direction of an asset. However, many traders believe that it is best to buy at the resistance level, because this will protect your investment in case the price moves lower.

Others feel that waiting for the price to break through offers more potential for profits, as there is a greater chance that the market will move higher after breaking through the resistance level. Ultimately, it depends on your individual strategy and preferences.

Is Bitcoin forming a head and shoulders?

Bitcoin has been forming a head and shoulders pattern for the past few months. The pattern is simple, but it’s indicative of a rally in the price of Bitcoin.

The head and shoulders pattern is typically formed when the price of an asset increases rapidly, then declines slowly before increasing again. This pattern can be seen in other markets as well – for example, stocks and commodities.

It’s unclear why Bitcoin is forming this pattern, but it could suggest that there’s a potential for further growth in the market. If that happens, investors could see their investments grow significantly over time.

What is bullish divergence?

What is bullish divergence?

A bullish divergence occurs when the prices of two assets move in opposite directions. This could be a good or a bad sign, and you need to watch out for it if you want to make money in the market.

The main reasons why divergence could occur are:

-If one asset is reaching new all-time highs while the other is significantly underperforming, that could be a sign that the market is starting to believe that the asset with the higher price is overvalued. This can create a bit of a buying opportunity for those who are prepared to take action.

-When there are large movements in both directions, it’s usually a sign that somebody (usually an institutional investor) is strongly influencing the market. They’re likely trying to get an idea of where the market is going before making any decisions. If you’re able to capitalize on this information, you’ll be well on your way to making some money.