If you’re like most Americans, you’re probably wondering about the Thrift Savings Plan (TSP). If you’re not familiar with it, the TSP is a government-sponsored retirement account that allows individuals to contribute up to 18% of their income each year. What’s great about the TSP is that contributions are tax-deductible, so it can be a really valuable tool for saving for retirement. In this guide, we’ll outline all the basics of the TSP and help you figure out whether or not it’s right for you. Plus, we’ll provide a full guide on how to make contributions in 2022 – so don’t miss out!

What is the maximum percentage I can contribute to my TSP?

The maximum percentage you can contribute to your TSP each year is based on your pay level and age. The table below shows the maximum percentage for each pay level.

If you are under 50 years old, you may be able to contribute a total of $18,500 to your TSP each year. If you are over 50 years old and have at least one child under 18 years old who is also enrolled in college or active duty in the military, you may be able to contribute a total of $24,000 to your TSP each year.

If you are between 50 and 59 years old, you may be able to contribute a total of $23,000 to your TSP each year. If you are between 60 and 69 years old, you may be able to contribute a total of $22,000 to your TSP each year. If you are between 70 and 79 years old, you may be able to contribute a total of $21,000 to your TSP each year.

If you are over 80 years old, you may be able to contribute a total of $19,000 to your TSP each year. If any of your children is also enrolled in college or active duty

How much can I contribute to my Roth TSP in 2022?

The Roth TSP allows you to contribute up to $18,000 in 2022. This figure has not changed since 2011, so it is important to be aware of the rules that apply to TSP contribution amounts in 2022.

If you are age 50 or older by the end of 2020, you can contribute an additional $6,000 to your Roth TSP. This brings the total amount you can contribute in 2022 to $22,000.

You can also make a non-deductible contribution of up to $2,500 per year ($5,000 if you are age 50 or older). This brings the total amount that you can contribute in 2022 to $24,500.

Keep in mind that these contribution limits apply only to your Roth TSP account – they do not apply to your traditional TSP account. In other words, if you have a traditional TSP account with a contribution limit of $18,500, you are still able to make contributions up to the $22,000 limit for your Roth TSP account.

Remember: If you have enough money saved up in your Roth IRA and Traditional IRA accounts, you don’t need to make any additional contributions to your Roth T

How much can I max out my TSP in 2021?

The Thrift Savings Plan (TSP) allows members to invest their money in government securities. Your TSP account can grow tax-deferred until you reach $2,000 in cumulative contributions. At that point, any remaining contributions will be taxable.

If you are looking to maximize your TSP contributions for the year, you should start planning early. The TSP has specific rules about when and how much you can contribute during the year.

The TSP allows members to make a total of $18,500 in 2019 contributions ($5,500 if age 50 or older). This limit is based on your account balance as of December 31st of that year.

If your account balance is less than $18,500 at the end of 2019, you can still make contributions up to the full $5,500 limit. However, any subsequent contributions will be decreased by the amount of any prior contributions on an annual basis. This means that if you make a contribution of $2,000 on January 1st 2020 and another contribution of $1,000 on February 1st 2020, your 2020 contribution limit will be lowered to $4,500.

For people over 50 years old who want to contribute more than

Can I contribute 100% of my pay to TSP?

The Thrift Savings Plan (TSP) is a great way to save for your future. If you are eligible, you can contribute 100% of your pay to the TSP.

There are a few things to keep in mind when contributing to the TSP. First, you need to make sure that your employer participates in the TSP. If your employer doesn’t participate in the TSP, you won’t be able to contribute any of your pay.

Second, you need to make sure that your pay is eligible for contributions to the TSP. Your pay includes any bonuses, commissions, and overtime pay that you receive.

Third, you need to make sure that your salary is high enough so that you can contribute enough money to the TSP each year. The maximum amount that you can contribute each year is $18,000.

If you are eligible and want to contribute your pay to the TSP, start by contacting your employer or contacting the TSP office nearest you. You can also find more information about the TSP on our website.

Should you max out your TSP?

The Thrift Savings Plan ( TSP ) is a retirement savings plan offered by the federal government. It allows employees to save money for retirement through employer contributions and employee investment earnings.

If you are eligible, it is generally recommended that you make the maximum contribution to your TSP each year. The maximum contribution for 2018 is $18,500. This means that you can contribute up to $2,500 more than the legal limit if your employer allows it.

There are a few reasons why making the maximum contribution to your TSP may be a good idea. First, contributing more will help you reach your retirement goals faster. Second, over time, the returns on your investments in your TSP will be higher if you make the maximum contribution.

If you are not sure whether or not to make the maximum contribution to your TSP , or if you would like to discuss a possible contribution increase with your employer, please contact us at [phone number]. We would be happy to help you reach your retirement savings goals!

What happens if I put too much in my TSP?

If you contribute too much money to your TSP account, it will be immediately removed from your account and you will not be able to make any more contributions for the calendar year. You may still be able to make contributions for the following calendar year, but you will have to wait until the next contribution window opens.

If you overcontribute, your account balance will be reduced by the amount of excess contributions. This reduction in balance will happen even if you do not make any further contributions for the rest of the calendar year. The reduction in balance is an automatic process that takes place each year on or about January 31st.

If you overcontribute by more than $2,500, your TSP account may be closed and all of your accumulated earnings and benefits withdrawn.

Does TSP contributions automatically stop at limit?

The Thrift Savings Plan (TPS) allows federal employees to save for retirement through a 401(k) plan or a TSP. If you are contributing to a TSP, your contributions automatically stop at the annual income limit. This means that if your income rises above the limit, your contributions will no longer be accepted.

If you are contributing to a 401(k) plan, your contributions will continue even if your income rises above the income limit. In other words, your employer will contribute additional money to your 401(k) account even if you earn more money than the annual limit.

If you are contributing to a TSP, it is important to keep track of your income and contribution limit. This way, you can determine whether or not you are still eligible to contribute to the TSP.

How do I maximize my TSP contributions?

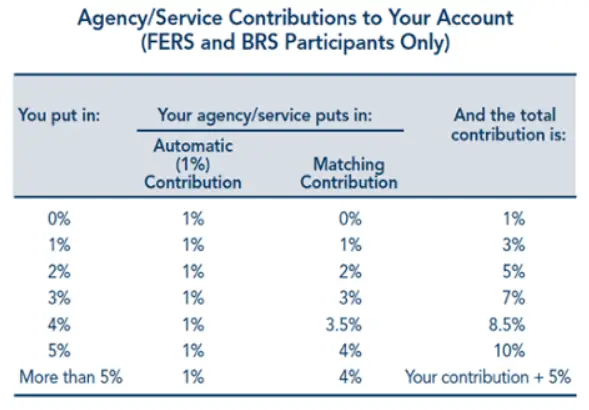

If you’re eligible for the TSP, you can make contributions in a number of ways. The most important thing to remember is that you need to contribute the equivalent of at least 1.50% of your salary, which is automatically deducted from your paycheck each month. You can also make lump-sum contributions or split your contribution between employer and individual Roth IRA accounts. Here’s a full guide on how to maximize your TSP contributions:

https://www.tspdirect.com/content/tsp-guide-maximizing-your-tsp-contributions