In this article, you’ll learn how to calculate and apply an easy formula for determining whether or not an organization will break even over a given period of time.

Operating income is an accounting term that refers to the total profit a business earns after paying its expenses. It’s calculated by subtracting fixed costs (e.g. rent, utilities, etc.) from revenue.

Fixed Costs = Revenue – Expenses

To figure out a business’ expected earnings, you need to do a few things:

First, you must determine your operating expense. This is the amount of money it takes to keep the lights on, pay salaries, buy inventory, etc. You can find this information easily in most books, online calculators and spreadsheets. For example, let’s assume you run a restaurant. Your monthly operating cost might be $12,000.

How to Find Operating Income From Revenues

When you’re looking to make money, you need to be aware of the different ways that you can generate revenue. If you want to know more about this, you should check out the article below. This is a guide that will help you to understand the concept of operating income.

You might have heard of the term “operating income” before. However, you may not fully understand what it means. So, let’s take a look at the definition of operating income. The first thing to note is that it refers to the profits that come in while the business is running.

In other words, it’s a way of measuring the performance of a company. You can use operating income to compare the financial health of two companies.

If you want to increase your chances of making more money, then you’ll need to focus on increasing your operating income.

How do you go about doing this? Well, there are several things that you could try. For example, you could cut down on costs. Or, you could start offering new services and products to customers.

What Is the Formula for Operating Income?

There are many different ways of calculating the amount of money that you need to operate your business profitably. The most basic way of doing this is to take all of the expenses, subtract them from the total sales, and divide the result by the number of employees. This is known as the cost of goods sold (COGS).

If you want to calculate the value of the company’s net worth, you can use the following equation:

Net Worth = Total Assets – Liabilities + Equity.

This means that the net worth of a company equals the sum of its assets minus the liabilities and equity.

You should also keep in mind that the amount of revenue that you generate depends on how much work you do. If you have more customers, then you will make more money than someone who has fewer clients.

In addition to these two formulas, there are other methods that can be used to determine whether or not a particular business is profitable. For example, you could look at the rate of return, the ratio of profits to costs, and the rate of growth.

Is Operating Income Equal to Revenue?

It is important to know that your business will be successful when you have enough money in the bank. You need to make sure that you don’t spend more than you earn, otherwise you won’t have any extra cash left for investing.

You should also ensure that you’re making a profit. If you aren’t, you’ll end up losing lots of money.

If you want to calculate how much money you have in the bank, you can use the formula below.

(Revenue – Expenses) = Net Profit

For example, let’s say you made $100,000 in sales last year, but you spent $50,000 on expenses. Then, your net profit would be $50,000.

Your profits are the difference between what you sell and what you pay for your products. The higher your profits, the better off your company will be.

In order to increase your revenues, you may want to focus your attention on increasing customer satisfaction. This means that you should try to provide high-quality services at a reasonable price.

Is EBIT the Same as Operating Income?

EBITDA is the total amount of money that a company makes each year after taxes. This figure shows how much profit a business made in its most recent fiscal period.

When companies report their results to investors, they generally include both an Operating Income (EBIT) and an Earnings Before Interest, Taxes, Depreciation, and Amortization (or just plain old EBIT).

These two figures are very different from one another. The first number includes all of the profits that the firm generated throughout the entire year. It doesn’t matter whether these profits were earned in a single month or a whole year.

The second figure, however, is calculated by subtracting out any expenses incurred by the business. It’s the amount that the company actually keeps for itself.

This means that the difference between the two numbers is the actual cash that was left over at the end of the year.

Companies tend to use this measure when they want to compare themselves with other businesses. For example, a firm might say, “Our last quarter saw an increase in earnings of $1 million.

Is Operating Profit the Same as Net Revenue?

You have to know that the term “operating income” is different from the term “net revenues”. You can’t use these two terms interchangeably. The difference between the two is the following.

Net revenues: This is the total amount of money that your business generates. For example, you might earn $1,000 in net revenues each month.

Operating income: Operating income refers to the total amount of money that you spend on running your business. For example, if you pay yourself a salary of $2,500 per month, then you’ll also be spending this much on operating expenses.

In addition, you need to understand that there’s another type of income. This is known as “profit.” Profit is the total amount of money that you make after all of your costs are paid. In other words, it’s what your company makes when everything else is taken into consideration.

So, how do you calculate profit? First, add up the amounts of cash and inventory that you’ve sold.

Operating Income Formula

When you’re running your own business, you need to make sure that you have enough money to cover all of the expenses. Otherwise, you could end up losing a lot of cash.

You should also be able to pay yourself a decent salary. If you don’t get paid well, then you might end up spending more than you earn. This is why you should try to set aside some of the profits from each sale. You can use these funds to help you with the costs associated with running your company.

One of the most important aspects of being a successful entrepreneur is managing the finances correctly. Make sure that you keep track of how much you spend and what you’re earning. Then, you’ll know whether or not you’re on the right path.

If you want to learn more about this topic, then you can read the article below. It’s a guide that will teach you everything you need to know about the subject.

Operating Income Vs Revenue

When you’re thinking of starting your own business, you need to understand how much money you’ll have to work with. If you don’t know where to start, then the article below will help you to get started.

There is no such thing as an exact amount of money that you should expect to make from running a business. The truth is, you never really know exactly how much you’ll be able to earn until you actually launch your company. However, you can use the numbers provided by the government to figure out roughly what you might end up making each year.

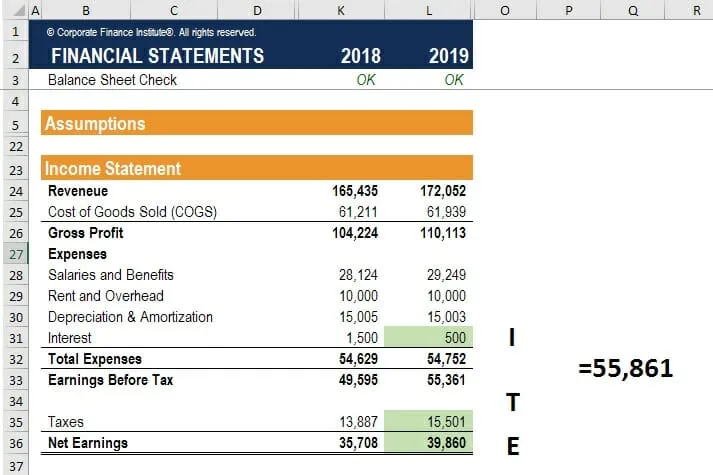

This is known as “operating income.” Operating income is calculated using the following formula:

Revenue – Expenses = Operating Income

If you want to learn more about this concept, then read on. You’ll find that there are many ways to calculate operating income. For example, you can look at your expenses, or you can also take a closer look at your revenues. Either way, the idea is the same.

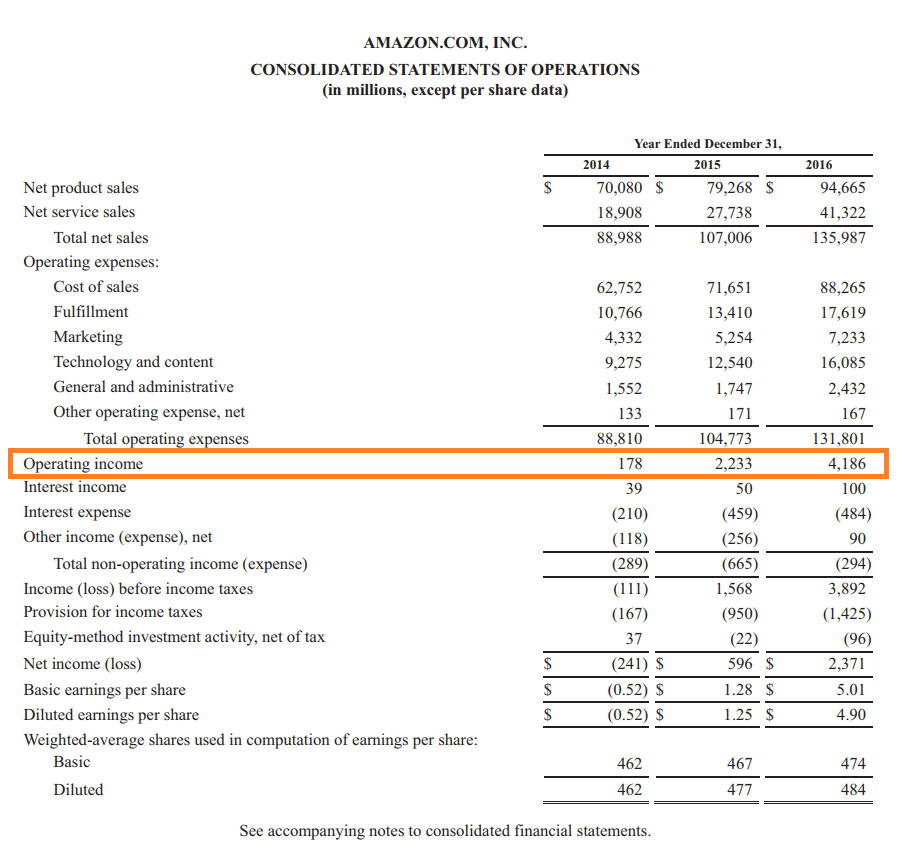

Operating Income Examples

There is no doubt that you can make money by investing. However, you might be wondering how to actually get started. This article will explain how you can create your own business using the stock market.

When it comes to creating a successful company, you need to start with the right ideas. If you want to make sure that you have the best chance of succeeding, you should always base yourself on sound principles. One of these principles involves understanding the difference between operating income and net income.

Net income refers to all of the revenue generated from the sale of products and services. Operating income is simply the amount of profit left after you deduct expenses.

You can use this information to determine whether or not a particular investment is worth making. For example, if you find that your operating income exceeds your costs, then you know that it’s possible to turn a profit.

If your operating income doesn’t exceed your costs, however, this means that there is no way that you could ever earn enough to cover them. In other words, the investment isn’t going to work.

Net Operating Income Formula

Net Operating Income (NOI) is a financial term used to describe how much money the real estate property generates. This number can be calculated by dividing the gross rental revenue by the total cost of owning the building.

In order to calculate this, you will need to know the following:

Gross Rental Revenue: The amount of rent paid on the property.

Total Cost of Ownership: All expenses that are required to own the property. This includes all costs associated with buying, maintaining and repairing the building.

You can also use the Net Operating Income Formula to help you understand NOI.

NOI = Gross Rental Revenues – Total Expenses

If you want more information on calculating the NOI, then please check out our website at https://www.myfinanceplanner.com/real-estate-investing.

Here are some other tips to help you improve your business.

1. Have a strong marketing strategy. If you don’t have one, you’re missing an opportunity to attract new clients.

Operating Income Vs Operating Profit

An operating income is a measure of how profitable your business actually was over a specific period of time. This number can be found by adding together all of the revenue that you received from sales, minus any costs associated with running your company.

This type of figure is useful for determining whether or not your business is making money. If it isn’t, you’ll want to make sure that you’re doing everything possible to increase the amount of income you receive.

On the other hand, an operating profit is a more general term. It’s used to describe the overall profitability of a company. To calculate this, you need to add up the total cost of goods sold and subtract the total expenses incurred while running your business.

These figures are usually reported in the financial statements that your accountant prepares for you. The bottom line is that you should always try to keep your operating profits as high as possible.

If you don’t do this, then you could find yourself losing money instead of earning it.

Operating Income Vs Gross Profit

When you’re running a business, you have two main sources of revenue. The first is your sales, and the second is your cost of goods sold (COGS). This means that your company makes money when customers buy products from you, but it also loses money whenever the items in its inventory are used up.

While these are the two primary ways for a business to make money, there are many other factors involved. For example, you might need to pay rent for office space, or you may be paying employees. You’ll also need to cover the costs associated with marketing, advertising, and customer service.

These expenses can add up quickly, and they don’t always go away. That’s why you should try to keep your profits high by reducing the amount of time it takes to sell each product.

Another way to increase your profits is to lower your COGS, or your cost per unit of sale. If you can reduce this number, then you’ll end up making more money.