In business, prorate means to share or apportion a part of something amongst several people or entities. For example, in order to allocate an expense among employees, the company might prorate the cost according to how much time the employee spends working on that particular project. When it comes to prorating legal responsibilities, you might also have to prorate your liability according to who was involved in the wrongdoings. This means dividing up responsibility based on who knew what and when they knew it.

What is an example of proration?

Proration is the dividing of something into parts in order to calculate its value. For example, if you have 10 cookies and want to give away 5, you would prorate the cookies by taking the number of cookies in each batch and dividing it by the total number of cookies.

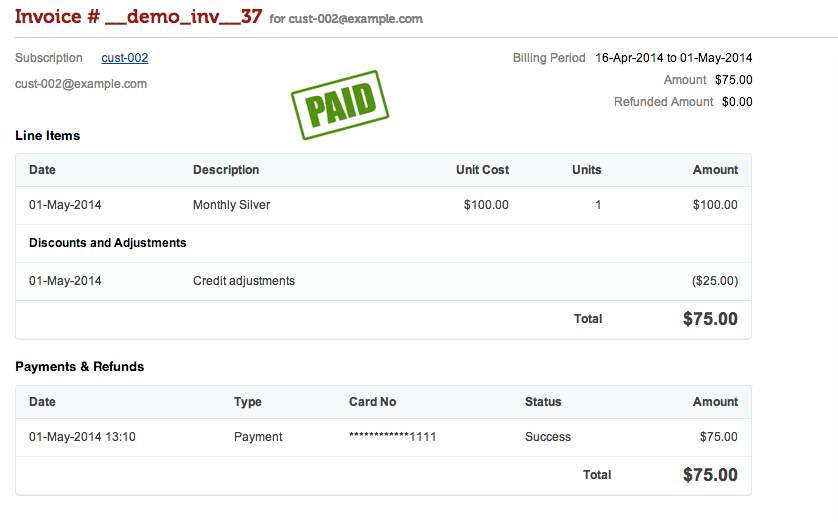

What is billing proration?

Billing proration is the process of allocating the cost of a service or product to various billed periods. This helps ensure that each customer receives their fair share of the total cost, regardless of when they incurred the expense. It can also help prevent overbilling and ensure accurate billing records.

How do you calculate proration?

Proration is the process of allocating a share of work to each employee. In most cases, it is necessary when an organization has more than one employee working on the same project or task. Proration can also be used in times when an organization has excess capacity and needs to divide resources among its employees in a way that meets their individual contribution levels.

There are several ways to calculate proration, but the most common approach is time-and-a-half for every hour worked over a certain number of hours in a day. That means if you are scheduled for 10 hours of work, you will receive 1½ hours of pay for every hour worked. However, if your shift starts at 7am and ends at 3am, you would only receive 40 minutes’ worth of pay for those 10 hours – even though you worked 10 hours!

There are other methods that can be used to calculate proration, but the time-and-a-half method is the most common.

What’s the opposite of prorated?

The opposite of prorated is pro-rated.

proration stripe

A proration stripe is a formal line on a flag that separates the upper and lower hoist strips. It is also the name given to the narrow white band near the top of a flag’s blue field, which is used to divide the flag into equal horizontal stripes.

proration in spanish

Prorate in Spanish is the act of distributing a fixed amount among several persons or things. In simple terms, proration is the process of dividing a given quantity into smaller parts so that each part receives an equal share.

The word proration comes from the Latin term pro ratione, meaning “according to proportion.” Proration is used in business and accounting to determine how much money must be paid out to various subcontractors, suppliers, and customers. It’s also used in law to apportion damages between plaintiffs and defendants.

When dealing with money, proration is important because it ensures that everyone involved gets their fair share. For example, if you have ten friends who want to go out for dinner, you can’t just give everyone a free meal. You have to divide the total cost among all ten people. Similarly, if you’re paying someone $100 per hour to do work on your project, you have to divide that money up among all the hours that person worked.

There’s a bit of a nuance involved when applying proration in Spanish. You always want to make sure that everyone involved understands what’s happening and agrees to it. For example, if you’re dividing a cake among ten friends,

proration pronunciation

The word ‘proration’ is a word that is typically used in accounting and finance. It is defined as the division of an output into its constituent parts. The term can also be used to refer to a financial technique that allows businesses to manage their cash flow.

There are various ways in which proration can be used in business. For example, it can be used to distribute the total cost of a project amongst its participants. This prevents companies from overspending on individual projects, and helps them to plan for future expenses.

In terms of finance, proration can be used to allocate income and expenses between different accounts. This ensures that all relevant transactions are accounted for, and that the correct amounts are being paid out each month.

Overall, proration is a important term in business and finance. It can help companies to stay organized and budgeted, while also ensuring that all transactions are accounted for.

proration accounting

What is proration?

Proration is the process of apportioning a fixed charge or dividend among several holders who are entitled to share in the proceeds. It is also the calculation of the proportionate share of an owner in a property, enterprise, etc., after deducting any liabilities owed by that entity to others.

proration real estate

A proration is a calculation of the percentage of ownership of an interest in property or assets. In real estate, proration is used to determine the amount of commission and other fees that a real estate agent may receive from selling a property.

proration calculator

What is proration?

Proration is the process of dividing an amount into smaller, specific amounts. It can be used in a variety of calculations, including financial and accounting ones, to make them more manageable.

What does proration mean?

The definition of proration is “the process of dividing an amount into smaller, specific amounts.” In practical terms, proration is used to determine how much of a particular item or quantity remains after another item or quantity has been removed. It’s also used in accounting and finance to make calculations more manageable.

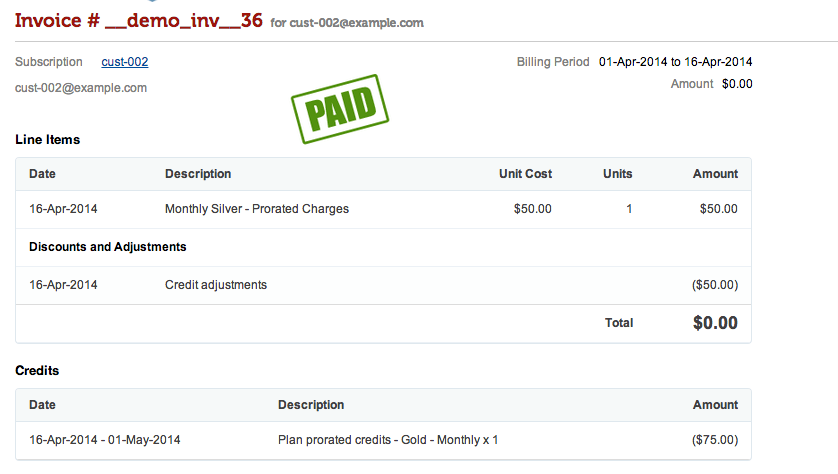

proration credit

1. What is proration credit?

Proration credit is a term used in accounting that refers to the allocation of responsibility for a financial obligation between two or more entities. In other words, it is the process of apportioning a particular financial obligation among the various participants in an agreement or arrangement.

2. When is proration credit necessary?

Proration credit may be necessary when two or more entities are obligated to share a financial burden, but do not have an exact figure for how much each should contribute. For example, suppose Company ABC owes Company XYZ $10,000, but does not know how much each company should contribute. With proration credit, each company would be assigned a proportionate share of the total indebtedness and each company would know exactly what it owes.

3. How is proration credit determined?

The determination of proration credit can be tricky, because it requires careful analysis of all relevant factors involved in the arrangement or agreement. Factors that may be considered include:

the type and amount of the financial obligation

the relative importance of the respective companies

the terms and conditions of the arrangement or agreement

proration synonym

Proration is the act of apportioning or allocating a share of something to someone. In accounting, proration is the process of allocating expenses and income between various entities in a company. In other words, it is the practice of dividing a whole into parts in order to account for its makeup.

Proration can be done on a per-item, per-period, or per-customer basis. Per-item proration means that each item in inventory is assigned its own share of the total cost, while per-period proration divides expenses by the number of months in a fiscal year. Per-customer proration takes into account the number of individual customers who have made purchases during a certain time period.

When deciding how to prorate an expense, you must first determine how much money was spent and then divide that amount equally among all the items that were impacted. You cannot use fractional amounts when prorating expenses – everything must be rounded up to the nearest dollar.