You probably know that you have to pay out-of-pocket for some health care services before your insurance kicks in. But did you know that the amount you have to pay can vary depending on what type of plan you have? In this full guide, we’ll explain how deductibles, coinsurance and copays work and which ones you might be affected by. So read on to learn more!

What is a deductible and how does it work?

When you go to the doctor, there is always a chance that something may come up that requires more than just a quick check-up. In these cases, you might have to pay for the doctor’s visit and any tests or prescription medicines out of your own pocket.

Most health care providers have tiers of coverage, with different prices for different levels of coverage. For example, Group Health [1] offers a bronze plan with a $50 deductible. If you use your insurance and your deductible is met, then the insurance pays for the remainder of the bill. The silver plan has no deductible, while the gold plan has a $2,500 deductible.

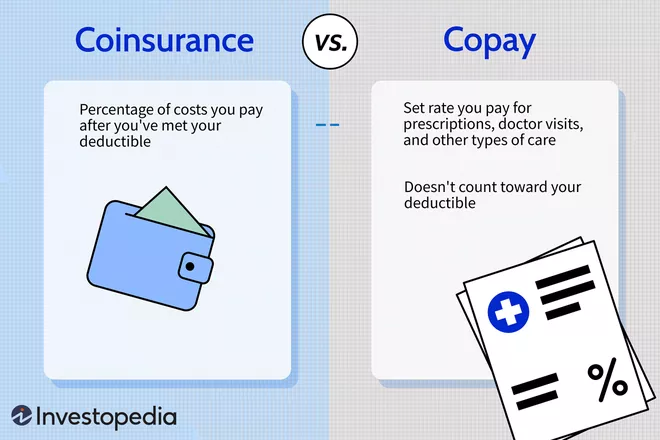

If you don’t have insurance or if your deductible is too high, you might have to pay for part or all of the bill yourself. This is called copays or coinsurance. Copays are usually based on how much money you make each year [2]. For example, if you make $60,000 a year and have a $25 copay for a doctor visit, that means you would have to pay $12.50 out of your own pocket for every doctor visit.

Coinsurance works pretty much the same way as

What does it mean to have a $1000 deductible?

When you buy a car, one of the most important decisions you’ll make is how much you’re willing to spend on repairs and maintenance. You may want to spend less on repairs, or you may want to spend more.

There are three different types of expenses you can incur when you own a car: deductible, coinsurance and copays. Here’s a brief overview of each:

A deductible is the amount of money you have to pay out-of-pocket before your insurance kicks in. For example, if your car has a $500 deductible, you must pay $500 out-of-pocket before your insurance company starts paying for repairs.

Coinsurance is the percentage of the cost of repairs that your insurance company will cover. For example, if your car has a $500 deductible, and coinsurance is 10%, your insurance company will cover $50 of every $500 worth of repairs.

Copays are the amounts you have to pay for each doctor’s visit, hospital admission or pharmacy prescription. For example, if your car has a $50 copay for doctor’s visits, and a $100 copay for hospital admissions and prescriptions, you would have to pay $100 out-of-

What is the purpose of a deductible?

A deductible is a fixed amount that a patient must pay before their health care provider will begin to treat them. This can help encourage people to get preventive care and lower the cost of care overall.

Coinsurance is a percentage of the cost of care that a patient pays, based on how much they spend. For example, if you have a coinsurance of 30% and your doctor charges $100 for surgery, you would pay $30 out-of-pocket and the remainder – $70 – would be covered by your insurance.

Copays are a set amount that patients must pay for each visit to their doctor or other health care provider. For example, if you have a copay of $25 for each visit to the doctor, you would have to pay $50 each time you see your doctor.

Do you want a high or low deductible?

Deciding how much you want to spend out of your own pocket on medical expenses can be a difficult decision. That’s where deductibles, coinsurance and copays come in.

Deductibles are the first dollar that you pay out of your own pocket for medical expenses. The higher the deductible, the more you will have to pay out of your own pocket before your insurance kicks in. Coinsurance is a percentage of the total cost of the care that you receive that is paid by you (the patient). Copays are a set amount that you have to pay for each visit to the doctor, hospital or other medical service.

There are pros and cons to each type of medical expense payment system. A high deductible may be ideal if you’re confident you can afford to pay out of pocket for most medical expenses. A low deductible may be better if you anticipate having to use your insurance frequently. Copays can be a pain if you have to visit the doctor often, but they can also help lower your overall health care costs.

Is it good to have a $0 deductible?

Deductibles, coinsurance and copays are all terms that are used when talking about health insurance. What do they mean, and how do they work?

A deductible is the first amount that you have to pay out of your own pocket before your insurance starts to cover anything. This is usually the smallest amount that you can afford to pay out of pocket each year.

Coinsurance is the percentage of your bill that you have to pay out of your own pocket. This is usually a fraction of the total bill. For example, if your deductible is $500 and your coinsurance is 20%, you will have to pay $100 out of your own pocket for every $1,000 that you spend on health care.

Copays are the amounts that you have to pay in order to receive health care services. This could be anything from a doctor’s visit to prescription drugs. Copays can vary greatly from one insurance company to another, so it is important to read the fine print when choosing an insurance policy.

Is it better to have a $500 deductible or $1000?

When it comes to health insurance, there are a lot of factors to consider. One important decision is whether to have a $500 deductible or a $1000 deductible.

A $500 deductible means that you would need to pay out-of-pocket before your health insurance company will cover any expenses. This is often the preferred option for people who are healthy and don’t expect to use their health insurance coverage very often.

A $1000 deductible, on the other hand, means that you would only have to pay out-of-pocket once during your policy period. This is the option most people choose when they are expecting to use their health insurance coverage regularly.

There are also other factors to consider when deciding whether to have a $500 or $1000 deductible. For example, if you have a low income, a $500 deductible may be more affordable than a $1000 deductible. And if you have children, a $500 deductible may be more appropriate than a $1000 deductible.

Overall, it’s important to weigh all of the pros and cons before making a decision about deductibles and copays. It’s also important to remember that each person’s situation is different

What happens if I can’t pay my deductible?

If you can’t pay your deductible, your insurance company will likely bill you for the entire cost of the procedure. This means that you’ll have to pay not just the coinsurance (which is a percentage of the cost of the procedure), but also the copay (a fixed amount that you pay at the time of service).

If you don’t have insurance, or if you choose a lower-priced policy with a higher deductible, you may be responsible for the full cost of the procedure, even if you can’t afford to pay your coinsurance or copay. In this case, you might want to consider borrowing money from a friend or family member to cover the cost.

Does insurance cover anything before deductible?

When you shop for health insurance, you may be wondering what the terms “deductible”, “co-payment” and “copay” mean. Here’s a quick guide to each:

A deductible is the first amount that you must pay out of your own pocket before your insurance coverage kicks in. For example, let’s say your policy has a $500 deductible. This means that you would have to pay out of pocket $500 before your insurance coverage would start.

A co-pay is the second amount that you must pay out of your own pocket before your insurance coverage kicks in. For example, let’s say your policy has a $50 co-payment. This means that if you need to see a doctor and the cost is $100, you would have to pay $50 out of pocket before your insurance coverage would start covering the rest of the bill.

A copay is the smallest amount that you must pay out of your own pocket before your insurance coverage kicks in. For example, let’s say your policy has a $10 copay. This means that if you need to see a doctor and the cost is $20, you would have to pay $10 out of pocket

What is a good deductible?

When it comes to healthcare, there are a few factors that you need to consider. One of these is your deductible. A deductible is the first amount you have to pay out-of-pocket before your insurance kicks in. This is typically the smallest sum of money that you must pay for doctor or hospital services. After your deductible has been met, your insurance plan will start to cover some of the costs associated with your care.

Another thing to keep in mind when it comes to healthcare is coinsurance. Coinsurance is a percentage of the cost of a particular service that you will be responsible for. For example, if you visit the doctor and they prescribe you a medication, your coinsurance might be 20%. This means that you will be responsible for 80% of the cost of the medication – even if you have insurance coverage.

Lastly, let’s talk about copays. Copays are payments that you make up-front for services like doctor visits or prescription medications. They can vary quite a bit depending on the type of service involved, but on average, they tend to range from $10-$50 per visit or prescription. Once you have met your deductible, coinsurance and copays no longer apply.

What happens if I pay more than my deductible?

If you pay more than your deductible, the health care provider will charge you an additional fee called coinsurance. This is usually 10% of the cost of the procedure or service. If you pay more than your copay, the health care provider will charge you an additional fee called a co-payment. This is usually $10-$25.

Do copays count towards deductible?

There’s a lot of confusion about how deductibles, coinsurance and copays work. This full guide will clear up all the confusion.

Deductibles are the first cost you pay out of pocket for treatment. Coinsurance is a percentage of the cost of care that you’re responsible for. Copays are a fixed amount you have to pay for each visit to the doctor or hospital.

Copays always count towards your deductible. So, if your deductible is $1,000, you must spend at least $100 before your insurance covers any further costs. If you have a 20% coinsurance rate, then you’re obligated to pay $200 out-of-pocket for each doctor visit, regardless of whether your deductible is met or not.

If you have a copay that’s higher than your deductible, then the copay will still count towards your deductible. But if your deductible is lower than your copay, then the copay will not count towards your deductible. So, if you’ve got a $50 copay and your deductible is $500, only $100 of that money will count towards the $1,000 deductible.

What is a normal deductible for health insurance?

A deductible is the first amount you pay out of your own pocket for medical expenses. After you have met your deductible, the insurance company will start to pay for your medical bills. Most health insurance plans have a set deductible, which is typically $100 or $500.

coinsurance is a percentage of the total bill that you pay, and it’s usually higher than the deductible. For example, if your health insurance has a $500 deductible and coinsurance of 30%, you would owe $300 after you have met your deductible.

copays are flat fees that you pay every time you visit the doctor or hospital. Copays can be quite steep, ranging from $20 to $100 per visit.

How do I get my deductible waived?

If you have a health plan with a deductible, coinsurance, and copay, you should be aware of how these works. Let’s take a look at each one.

The deductible is the first amount that you must pay out of your own pocket before your insurance will start to cover any costs. The higher the deductible, the more you will have to pay out of pocket before your insurance starts to cover costs.

Coinsurance is a percentage of the total cost of treatment that you must pay. This percentage is usually expressed as a dollar amount. For example, if your policy has a $1,000 deductible and 30% coinsurance, you would have to pay $300 out of pocket for every doctor visit or hospital stay before your insurance would start to cover any costs.

Copays are a fixed dollar amount that you must pay for each service or product that you receive during your treatment. For example, if your policy has a $50 copay for doctor visits and $100 per prescription drug, you would have to pay $10 for each doctor visit and $40 for each prescription drug before your insurance would start to cover any costs.

How much will raising my deductible save me?

When you go to your doctor, it’s important to know how much of the bill will be covered by your deductible and copays. Here’s a guide on how deductibles, coinsurance and copays work:

Deductible: The first dollar you spend out-of-pocket is covered by your deductible. So, if your deductible is $500, you can spend up to $500 before any of the costs associated with your visit are covered. After you reach your deductible, the medical expenses associated with that visit are calculated and only then do any coinsurance or copays kick in.

Copays: Copays are charges you pay after you have reached your deductible. For example, if you have a $500 deductible and have to pay $25 for a doctor’s visit, that would count as a copay.

Coinsurance: Coinsurance is what happens when you hit your deductible and then incur medical expenses. For example, if you have a $1,000 deductible and incur $2,000 in medical expenses during the year, the cost of those expenses would be paid 80% by your insurer (the coinsurance) and 20% by you (the co-pay).

Amount

Do you have to pay deductible twice?

When you go to the doctor, the doctor may ask if you have any medical conditions. If you do, your insurance company may require you to pay a deductible first before it will cover any of your costs. After you pay the deductible, your insurance company will usually require you to pay coinsurance (a percentage of the cost) and then find out how much of the cost is covered by your insurance policy. Your copayment is a fixed amount that you must pay for each visit to the doctor, hospital or other healthcare provider.

How do I meet my deductible?

When you meet your deductible, coinsurance kicks in. Coinsurance is a percentage of your bill that you pay. For example, if your deductible is $250 and your coinsurance is 20%, you would pay $40 out of pocket for each visit.

If you have a copay, it’s a fixed amount that you pay for each service. For example, if your copay is $10 for an office visit, you would owe $10 for each office visit.

Do you have to pay deductible before copay?

When a person visits a doctor or hospital, they may be asked to pay a deductible before they are responsible for paying their share of the bill. After the deductible is met, the patient is then responsible for paying their copay. This can be confusing, so here’s an overview:

If you have a health insurance policy with a deductible, you may have to pay that amount before your insurance company pays anything else – even if you don’t have to use any of the services that are covered by your policy. This is called the out-of-pocket maximum.

If you have a health insurance policy with coinsurance, you generally will only have to pay part of the cost of services – as long as your copay is less than your coinsurance amount. For instance, if your policy has a $50 copay and 10% coinsurance, you would be responsible for $5 out of every $50 billed.

If you have a health insurance policy with a copay, you’ll typically be required to pay only what’s listed on the bill – no more and no less.

Is deductible same as out-of-pocket?

Deductible, coinsurance and copays are all terms you’ll likely hear when discussing healthcare costs. But what do they mean? In this full guide, we’ll explain what each term means and how they work together to determine your out-of-pocket costs.

Deductible: This is the first amount you pay towards your healthcare costs before your insurer covers any of them. For example, if your deductible is $500, you would have to pay $200 out of pocket before your insurer begins to cover expenses.

Coinsurance: This is a percentage of the total cost of your healthcare that you will have to pay yourself. For example, if your coinsurance is $20 for every $100 worth of services you receive, you will have to pay $40 out of pocket for each service.

Copay: This is an amount you must pay for each service or item that you receive during a hospital stay or doctor visit. For example, if your copay is $25 for a hospital stay, you will have to pay that entire amount for each day of hospitalization

How does a deductible affect insurance?

A deductible is the minimum amount you must pay before your insurance company begins to pay medical expenses. For example, if your policy has a $500 deductible, you must pay at least $250 before your insurance starts to cover any costs.

coinsurance is how much of the cost of a medical service your insurer pays. This means that even if you don’t pay the full cost of a medical service, you may end up paying part of that cost.

Copays are payments you make in addition to your deductible and coinsurance. Copays can be anything from a few dollars to as much as 50% of the cost of a service.

Is a 2000 deductible good?

Understanding deductible, coinsurance and copays can help you save money on your health care.

When you get health care, you will usually have to pay a deductible. This is the first amount that you have to pay out of your own pocket.

After you have paid your deductible, your insurance company will start to pay for some of the costs of your care. This is called coinsurance. Coinsurance is a percentage of the cost of your treatment that you will have to pay.

You can also pay for some of the costs of your care with cash or credits that you earn through your insurance plan. This is called a copay.

Why is my insurance deductible so high?

In short, deductibles and coinsurance work together to calculate how much the insurance company will pay for a particular medical expense. The deductible is the first dollar you pay out of your own pocket, and the coinsurance is what percentage of that total you’ll be responsible for. So, for example, if your deductible is $1,000 and your coinsurance is 10 percent, the insurance company will only cover $100 of any medical expenses you incur.

Copays are simply additional payments you have to make towards your deductible or coinsurance. So, for example, if you have a $1,000 deductible and a 10 percent coinsurance, and you need to make a $200 copayment, you’re spending 20 percent of your entire deductible on medical expenses.

What is covered under a deductible?

A deductible is the amount you are required to pay out-of-pocket before your insurance company begins to cover any of your medical expenses. This is also known as the copayment. The coinsurance is how much of your eligible medical expenses will be covered by your insurance company, and the percentage is based on the co-pay you have chosen.

What do I do if I hit my deductible?

If you have reached your deductible for a particular health care service, you are responsible for paying the first $100 out-of-pocket for that service. If the cost of the service is more than $100, the health plan will likely require you to pay the balance of the bill. If you have hit your coinsurance limit, you may also be required to pay some or all of the bill. Finally, if you have hit your copay limit, you may only be required to pay a reduced amount of money toward the cost of the service.

What is a deductible vs copay?

Deductibles and copays are two common terms used when discussing health insurance. They both refer to the amount of money you have to pay out-of-pocket before your insurance starts to cover any medical costs.

A deductible is the first dollar you pay out of pocket for medical expenses. After you pay your deductible, your health insurance will start to cover costs up to a certain limit.

A copay is the amount you have to pay each time you visit a doctor or hospital. Copays are usually set at a fixed percentage of the cost of services rendered, so they don’t change with inflation.

Why do I pay copay and deductible?

Most people have at least one type of insurance coverage – health, car, home, life. But what do all these policies have in common? They all have deductible, coinsurance and copayments.

Deductible: The amount you have to pay before your insurance kicks in.

Coinsurance: The percentage of the cost of treatment that you are responsible for.

Copayment: The fixed fee you pay for each treatment or service.

What is considered a high deductible health plan 2022?

A high deductible health plan (HDHP) is a type of health insurance plan that has a high annual deductible. This means that you have to pay the entire cost of your healthcare premiums upfront, before your health insurance company will start to pay for your medical expenses.

HDHPs are popular among people who want to control their healthcare costs. This is because HDHPs have low copays and coinsurance, which means that you only pay a small percentage of the cost of your medical care.

The main downside of HDHPs is that they can be expensive. You will likely have to pay more in premiums and out-of-pocket expenses than you would with a standard health insurance plan. However, if you need serious medical care, an HDHP may be the best option for you.

What does it mean to have a $4000 deductible?

When you buy a car, one of the things you have to pay for is the car insurance. Car insurance is a way to protect you and your property if something happens while you’re driving the car. You usually have to pay a set amount each month in order to have coverage. This is called the premium. The premium is usually a percentage of the cost of the car, and it’s usually a fixed amount no matter how much money you make or how much cars you drive.

Another thing you have to pay for when you buy a car is the deductible. The deductible is the smallest amount that you have to pay out of your own pocket before your car insurance covers anything. For example, if your deductible is $500, then your car insurance will only cover losses up to $500. Anything above that will be covered by your insurance policy.

The third thing you have to pay for when you buy a car is the coinsurance. Coinsurance is another name for copays. Coinsurance is a fixed fee that you have to pay every time you get medical attention as a result of an accident that was caused by your car. For example, if the coinsurance for your car policy is $250 per accident, then every

Which is better PPO or HMO?

PPO vs HMO: Which is the Best Choice for You?

When it comes to choosing a healthcare plan, there are a few important things to consider. The type of coverage you have, the deductible and coinsurance you have to pay, and your copays. This article will discuss each of these in detail, and help you decide which is the best option for you.

Coverage Type: PPO or HMO?

The first decision you need to make is which type of coverage you want. PPO plans are preferred by many people because they offer more flexibility than HMO plans. With PPO plans, you choose the doctor and hospital that you want to use. This means that if you have a medical emergency, you can go to the nearest hospital without having to worry about whether or not your plan covers that facility. HMO plans, on the other hand, require that patients go through their provider’s network. If you don’t have coverage at your preferred hospital or doctor, then you may need to find a new plan.

deductible: How Much Does It Cost You?

With PPO plans, the first expense that you will typically have is a deductible. This is the

Is coinsurance or copay better?

This is a question many people have and one that can be difficult to answer. In general, coinsurance is better than copay because it means you pay a fixed percentage of the total cost of care instead of paying a set amount every time you visit the doctor or hospital. With copays, you are essentially paying for each service you receive. Coinsurance, on the other hand, means that you’re responsible for a certain percentage of the cost of care, no matter how much you spend.

The best way to figure out which option is best for you is to talk to your doctor or health insurance provider. They will be able to help you understand your coverage and give you an idea of what each option would cost.

Does copay go towards out-of-pocket?

When you go to the doctor or hospital, you might have to pay a copay. This is just a fee that you have to pay, and it’s usually a small amount. The copay goes towards your deductible, not your out-of-pocket costs. So, if you have a $500 deductible, and you have to pay a $25 copay, then your total out-of-pocket cost is $475.

What happens if I meet my out-of-pocket maximum before my deductible?

If you’ve already met your out-of-pocket maximum, your insurer will pay for the remaining costs of your medical bill without requiring you to pay anything out of pocket.

What happens when you hit out-of-pocket maximum?

Hitting out-of-pocket maximum is a common occurrence when you have to use insurance. Out-of-pocket maximums are specified dollar amounts that an individual or family may have to pay out of pocket before the insurance company begins to pay covered medical expenses.

What happens when you hit your out-of-pocket maximum?

If you’ve already spent your out-of-pocket maximum for the year, then the insurance company will stop paying for your medical expenses. The only way to continue receiving coverage is to get additional insurance, change plans or negotiate a lower out-of-pocket maximum with your insurer.

Deductibles and coinsurance are two other important pieces of insurance policy. A deductible is the first amount you must pay out of pocket before the insurance company starts to cover costs. Coinsurance is the percentage of costs that you must pay for services after you’ve met your deductible. For example, if your deductible is $1,000 and you have a coinsurance rate of 20 percent, you would have to spend $200 before the insurance company begins covering costs and would be responsible for 80 percent ($200 x .8) of any costs after that.

Copays are another type of

Is a 5000 deductible high?

When you visit a doctor, you may be asked to pay a deductible before your medical expenses are covered. This is the first fee you must pay before your health insurance pays for any of your care.

The deductible amount can vary from policy to policy, but it’s usually somewhere between $100 and $500. After you meet the deductible, your health insurance will start covering some of your costs.

In most cases, the coinsurance (the portion of your bill that you pay) is also based on your deductible amount. So if you have a $50 deductible, you’ll pay 20% of the cost of each bill above $50, up to your policy’s coinsurance maximum.

And finally, most policies also have a copayment (a fixed fee that you pay for each visit). The copayment is usually set at $10 or $20 per visit.