One of the most common financial metrics is year-over-year (YOY). This metric is used to measure changes in financial performance over time. In this article, we will explore what YOY is, how it’s used in finance, and some examples. So read on to learn more!

What means YoY?

The YoY (year-over-year) indicator is a financial metric that is used to compare the performance of a company or asset over a period of one year to the same period in the previous year. YoY analysis can be used to identify trends, assess performance, and make informed investment decisions.

How is YoY used in finance?

YoY analysis can help investors understand how a company or asset is performing over time, and can be used to make informed investment decisions. For example, if a company’s revenues are increasing YoY, this may suggest that there is an underlying trend of growth and future success. Conversely, if a company’s revenue decreases YoY, this may suggest that there is an underlying trend of contraction and future trouble.

What is YOY example?

The YOY example is a financial term that’s used to calculate the change in revenue or profits from one year to another over a period of time. This information can be used to help determine how a company is doing and whether there are any changes that need to be made.

The YOY calculation is based on the principle of compound interest, which means that over time, investments and earnings will increase more quickly than the original investment. This makes it important for businesses to monitor their progress over time in order to make sure that they’re making the right decisions and aren’t wasting money.

How is YOY calculated?

The year-over-year (YOY) calculation is a common financial ratio used in forecasting and analyzing performance. It is derived by dividing the current value of a security or asset by its value at the same point in the previous year. YOY can be used to compare performance between periods, identify trends, and make investment decisions.

There are a few factors to keep in mind when using YOY:

1. YOY should only be used as an overall measure of performance and not as a sole indicator of whether an investment is profitable or not. For example, stock prices can go up or down even if the company is doing well over the long term, depending on short-term market fluctuations.

2. The calculation does not take into account taxes, dividends, or other earnings that may have been generated recently. For this reason, it’s important to consult a financial advisor if you’re looking to use YOY as your sole tool for analysis.

3. YOY calculations can be affected by seasonal variations and other factors outside of an investor’s control (e.g., political conditions). Therefore, it’s important to use caution when interpreting results based on YOY data alone.

What is YoY and mom?

YoY is a term used in finance to measure changes over time. YoY is typically used when talking about revenue or profits. For example, if company A’s revenue rose by 10% YoY, this would be considered good news because it means that the company’s revenue grew faster than the overall market.

Mom is a term used in finance that stands for monthly or annual percentage change. Mom is similar to YoY, but it measures changes over months or years, rather than over a single period of time. For example, if company A’s profits rose by 10% MoM, this would be considered good news because it means that profits increased at a slower rate than the overall market.

What is a good YoY growth rate?

A good YoY growth rate is one where the company’s revenue increases by more than the inflation rate. A YoY growth rate can be helpful in making investment decisions and determining a company’s future success.

Why is YOY growth important?

When you’re looking to buy something, your focus is likely on either the past performance of the stock or the currency exchange rate. But what about investments like homes and cars? The answer is that these items can also be bought using “year-over-year” growth.

What is YOY growth?

When you see an investment quoted in terms of “year-over-year” growth, it means that what you’re buying is not only increasing in value, but doing so by a larger margin than it did last year. This metric is often used by investors because it’s a way to compare different investments within the same category.

Why use YOY growth?

There are a few reasons why investors might want to use YOY growth when investing in stocks, bonds or real estate.

First, if a company is doing well over the past year or two, odds are good that its performance will continue for some time to come. That’s because good companies tend to stay afloat during bad times – they’re resilient and their comeback stories are usually pretty inspiring.

Second, if you’re looking to buy a bond that pays interest every month, then your focus should be on how

What is YOY profit?

When a company releases financial statements, they report net income (NI) and net loss (NL). NI is the total revenue minus total expenses. NL is the same as NI, but it includes income from investments.

Net Income (NI) is one of two main measures of a company’s financial performance. Net Income (NI) is simply the profit after deducting all expenses from revenue. Expenses can include salaries, interest costs, taxes, and other associated costs. The goal of a company is to make as much money as possible while still keeping expenses under control.

With that in mind, companies use YOY profit to help them compare their performance from one year to the next. A company might release its annual results on May 1st and then release its YOY results on December 31st. The YOY results show how much money the company made over the past year, compared to the previous year.

There are a few things to keep in mind when looking at YOY profit:

1) Net income isn’t always equal to YOY profit – Sometimes expenses change between years, and this can affect how Net Income (NI) and YOY profit look.

2) Not all businesses

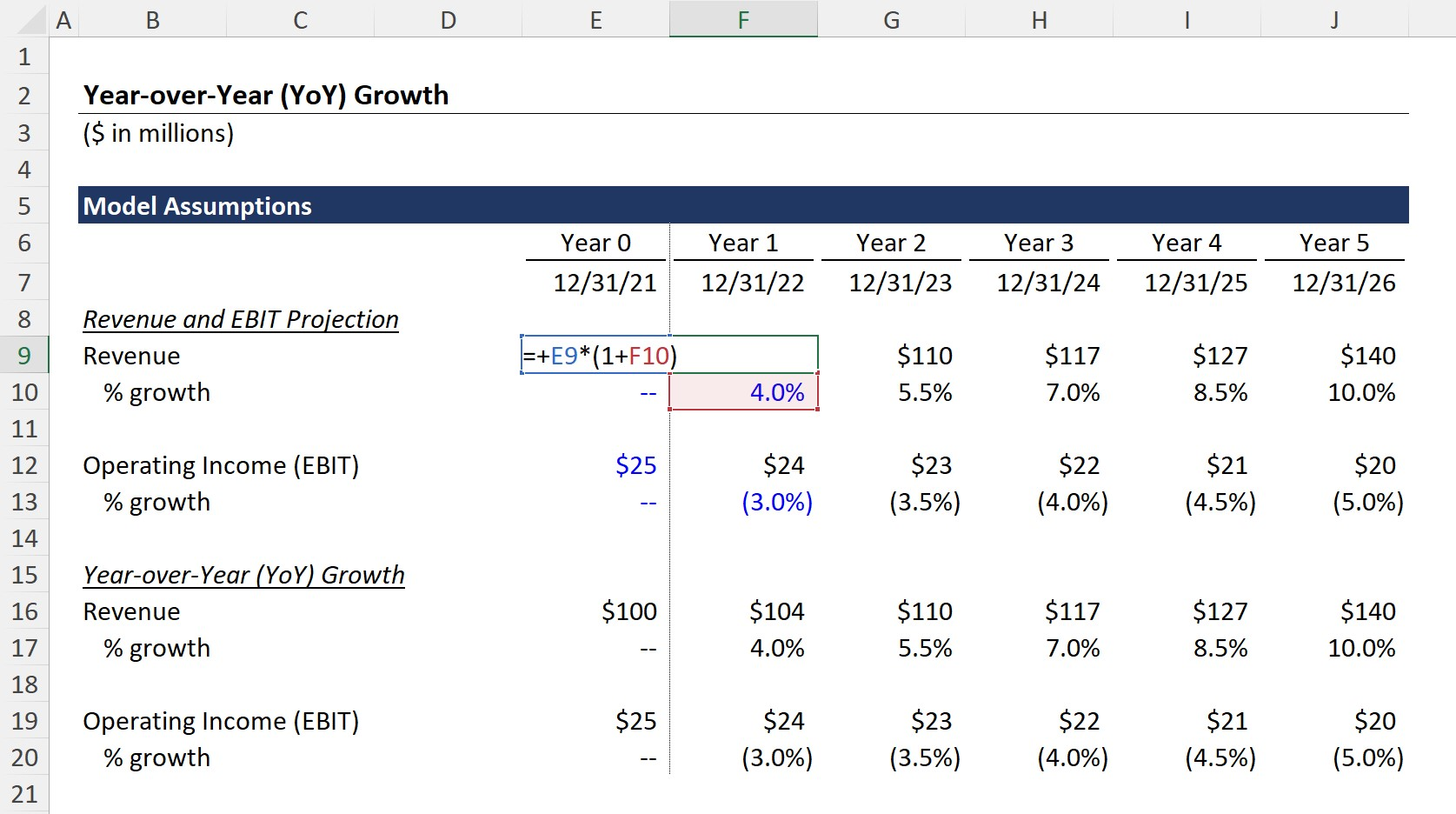

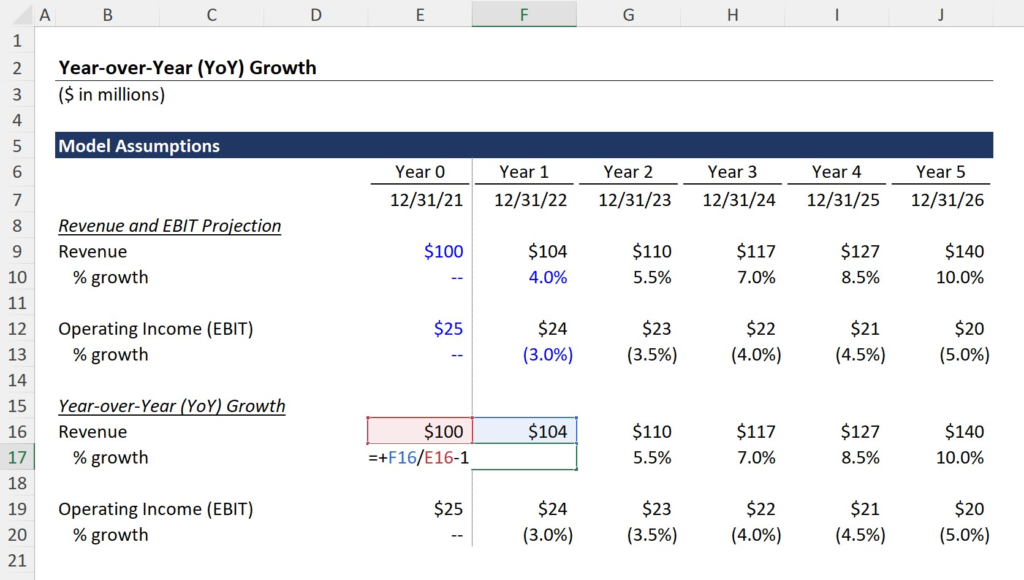

How do you calculate yoy in Excel?

When you want to calculate yoy in Excel, you first need to determine what type of data you’re working with. If you’re working with numbers that represent revenue or profits, for example, you would use the YOY function.

The YOY function takes a number as input and returns its value from one year ago to the present. For example, if your number represents revenue from last month, the YOY function would return $100.00.

To use the YOY function in Excel, simply type YOY into the cell you want to calculate it in and hit Enter. You can also use the shortcut Ctrl+Y (or CMD+Y on a PC).

What is good yoy growth for startup?

A key metric used in the financial world is “yoy” growth, which stands for year-over-year. This metric is used to determine whether a company is growing or declining year-over-year.

There are a few different ways to calculate yoy growth. The simplest way is to compare the current year’s sales with the previous year’s sales. If the company’s sales increased by more than 20%, then they would consider their yoy growth to be good.

Some investors and analysts also use other measures of yoy growth, such as net income or revenue. It’s important to remember that not all companies have the same definition of good yoy growth, so it’s important to check with your financial advisor before making any investment decisions.

How do you use YOY?

The simplest way to think of YOY is as a way to measure the change in a company’s performance over a certain period. For example, if you want to know how much revenue a company has increased by over the past year, you can use YOY to calculate that figure. Similarly, if you want to know how much profit a company has generated over the past year, you can use YOY to calculate that figure.

There are other ways to use YOY, of course. For example, you might use YOY when gauging whether or not a company is profitable enough to survive in the current market environment. You might also use YOY when assessing whether or not a company’s stock is worth buying or selling.

So overall, YOY is an important metric because it can help you understand how a company is performing and what kind of future outlook there might be for it.

How would you describe YOY growth?

The term “yoy” is typically used in finance to describe year-over-year growth. This is because it is a way to compare how different periods of time have performed relative to each other.

For example, if you own a company and you want to know how its performance has changed over the past year, you would use yoy growth to determine how much its profits have grown. Or, if you’re trying to decide whether or not to invest in a new business, you might look at yoy growth as a measure of whether or not it’s worth your time.

There are a few things to keep in mind when using yoy growth:

1. YOY growth can be affected by a number of factors, including economic conditions and company performance.

2. YOY growth doesn’t always correspond with historical trends. So it’s important to use it cautiously when making decisions.

3. YOY growth can be misleading if it’s used in isolation, rather than in conjunction with other metrics.

What is YOY change?

A quick refresher on year-over-year (YOY) change: YOY is a term used in finance to refer to the percentage change of a given financial metric from one year to the next. In other words, it’s a way of measuring how much an entity’s performance has shifted from one period to the next.

Typically, financiers and analysts use YOY change to gauge the progress or weakness of a company, sector, or market. For example, if a company’s sales are up by 10%, but its YOY change is only 5%, that suggests that its growth rate isn’t as strong as it could be. Conversely, a company with a YOY change of 20% may be experiencing strong growth.

How do you calculate YOY variance?

Variance is a key financial metric that measures how much an individual stock or portfolio’s price has fluctuated from its average over a certain period of time. The formula for calculating variance is:

where “X” is the price of the security at the beginning of the period, “P” is the price of the security at the end of the period, and “S” is the sum of the squares of all prices during that period.

The use of YOY variance can be seen in a variety of settings, including fundamental analysis and investment decision-making. For fundamental analysis, YOY variance can be used to identify underlying trends in a company’s stock prices. For investment decision-making, YOY variance can be used to help determine whether a particular investment is worth making.

How do you measure growth?

One of the most common ways to measure growth is by looking at year-over-year (YOY) numbers. Year-over-year, or YOY, numbers show how much an organization’s revenue or profit has increased from one year to another.

Many people use YOY numbers when analyzing a company’s performance because they are easy to understand and compare. In finance, YOY numbers are also used to calculate a company’s earnings per share (EPS). When calculating EPS, a company takes its annual revenue and divides it by the number of shares outstanding at the end of the prior year. This gives investors an idea of how much money the company made on each share of stock during the past year.

There are several reasons why companies might report higher or lower YOY numbers than their previous year. Factors that can influence a company’s performance include changes in market conditions, product sales, and employee productivity. It is important to take these factors into account when interpreting YOY figures.

What is yoy and qoq?

You’ve undoubtedly heard of yoy and qoq, but what are they and what do they mean?

Formerly known as “year-over-year (YOY)”, yoy is a measure of the change in revenue or profit over a given period of time, typically one year. It’s commonly used in finance to understand how a company is performing relative to previous years.

Qoq, meanwhile, is simply “quarter-over-quarter (QoQ)”. QoQ is used to measure the change in revenue or profit for a specific quarter over a previous quarter. This is especially important for companies that release quarterly results, as it allows investors to see how revenue and profits changed compared to the same quarter last year.