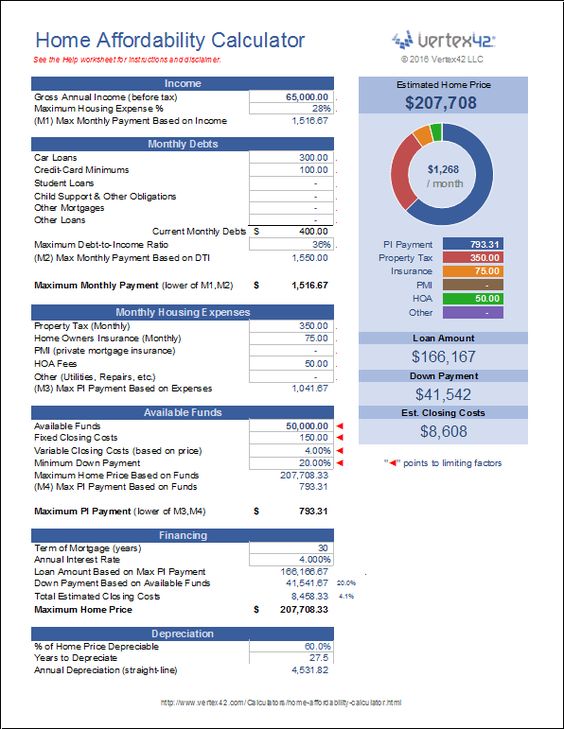

Affordability calculators help you find how much house you can actually buy. These tools help you work out how much you need to earn in order to pay for the loan on a particular property.

An affordability calculator is useful when looking for a home because it can tell you which properties are affordable and which ones aren’t. It also helps you compare different types of homes such as houses, apartments, townhouses, etc., so that you know exactly what kind of home will suit your budget.

You may be able to get an idea about what type of housing you would prefer by using a price per square foot calculator. This allows you to work out the cost of purchasing various properties.

However, this doesn’t mean you should go straight into signing up for a mortgage with no further research first.

How Much House Can I Afford

If you’re thinking about buying your first home, then this article is perfect for you. This guide explains exactly why you need to pay attention to the cost of housing before you buy.

When it comes to affordability, you should always make sure that you have enough money saved up. If you don’t, you might end up spending more than you planned. You also shouldn’t be so focused on the price tag that you ignore other important factors like location and size.

You should also consider whether or not you can actually afford the mortgage payments. The amount of interest you’ll be paying each month will depend on the type of loan that you choose.

It’s a good idea to work with an expert who knows what it takes to get financing for a new home. Your lender may offer special rates or lower down payment options.

Finally, you should think about whether or not you want to live in a particular neighborhood. Some people prefer living near their jobs, while others enjoy being close to the beach.

How Much House Can I Afford Based on My Salary?

This is a very important question that you need to answer before you buy your first home. There are many factors to consider when determining how much house you can actually afford.

First of all, you should be aware of the difference between the cost of the mortgage payment versus the monthly rent. If you have no idea where to start, you can use this calculator to help determine whether you can afford to purchase a particular property. This will give you an approximate figure for the total amount of money you’ll need to pay each month.

You might also want to take into account the value of the down payment you plan to make, and the interest rate on the loan that you’re considering. You may even want to consult with a real estate agent to get some advice.

There are plenty of other things that you can do to ensure that you know exactly what it is that you can comfortably afford, so don’t hesitate to ask for more information.

How Much House Can I Afford on a 70,000 Salary?

You need to consider many different factors when you’re trying to decide how much money you’ll be able to spend on your home. For example, you should take into account the cost of living in the area where you want to live. You also have to make sure that you don’t go beyond your means.

If you work full time and earn $70,000 a year, then you can expect to pay around $1,200 per month for rent. If you buy an average-sized home, you’ll likely end up spending more than this amount.

However, you shouldn’t worry about the total price of your mortgage. Your lender will automatically adjust your monthly payments so that you always come out ahead financially.

If you plan to stay in your current location for a long period of time, you might not even need to move. This is because you could save up enough money to cover the costs of moving.

How Much House Can I Afford Calculator

When you’re trying to buy a new home, you need to know how much money you have to spend. This is especially true when you want to get a mortgage. If you don’t know the exact amount that you’ll be able to borrow, it’s very difficult to make an informed decision.

Fortunately, there are calculators available online that can help you figure this out. The best thing to do is to use these tools to calculate your monthly payments.

If you want a more detailed look at what you can expect to pay, you should take a closer look at the numbers that come up. For example, you might discover that you can afford to purchase a $200,000 property.

However, you may also find that you only qualify for a loan of around $80,000. In this case, you could end up spending thousands of dollars more than you planned on.

You need to keep this information in mind when you’re making decisions about buying a home.

How Much House Can I Afford Dave Ramsey

If you’re thinking about buying your first home, you should know that you have a lot of options. There are many different ways to pay for your mortgage, so you need to be careful when choosing the best option. If you want to learn more, then keep reading.

You can use the conventional method, where you borrow money from the bank. This involves making monthly payments over the course of several years. The other choice is to make an all-inclusive payment, which means paying the entire amount in one lump sum.

However, these two methods are just a few of the available choices. You can also choose to get a fixed rate loan or a variable rate loan. And you can even combine the various methods to create your own unique plan.

There are a number of things that you should consider before you buy your next home. For example, you will want to look at the interest rates. You will also want to make sure that you understand the terms of the contract.

How Much House Can I Afford Zillow

Zillow is one of the most popular real estate websites on the internet. This means that you have access to a wealth of information regarding housing prices, mortgage rates, and more. If you want to know exactly how much money you need to make in order to buy a certain type of home, Zillow can help.

You can use the affordability calculator to figure out how many years you will be able to pay your monthly payments on an average-priced property. The best thing about this tool is that it allows you to choose from a variety of different factors. For example, you can decide whether or not you’ll consider the cost of taxes, utilities, and maintenance when calculating your budget.

As long as you enter your current income level, the website will give you a rough idea of what you should expect to spend on your new home.

If you’re planning on buying a single family residence, then you’ll likely have to put down at least 20 percent of the purchase price.

How Much House Can I Afford with 40k Salary

When you’re looking to buy your first home, you need to know exactly how much money you have available to spend on a property. This is why you should use the affordability calculator below.

This tool will help you figure out how much mortgage payments will be, based on the price of the house that you want to purchase. You can also get an idea of whether or not you can afford the monthly payment by entering information into the form.

You’ll receive the most accurate results if you enter all the numbers yourself. However, you can always ask someone who knows more about mortgages to help you fill in the blanks. If you’d like to find out how much house you can afford, then this is the best resource for you.

point:do not eat late at night, don’t drink alcohol, avoid stress, exercise regularly, take a break from work.

Salary Needed to Buy a House Calculator

If you’re looking to get a new home, you need to know how much money you have available to purchase one. If you don’t understand this, you might end up spending more than you want to.

You should start by calculating your current monthly expenses. You’ll be able to determine whether or not you can afford to make a down payment on a home. The next step is to figure out the amount that you need to earn each month.

Your first goal will be to save as much money as possible. After all, it’s always easier to pay off debt than to borrow it.

Once you’ve saved up enough cash, you can use the following formula to calculate the number of months that you have before you reach your target income level.

[(((2*(monthly savings/current mortgage balance))+downpayment)/12.]-1

This equation tells you the number of months that you have until you can afford to move into a new place.

Mortgage Affordability Calculator

When you’re looking for a new home, you need to make sure that you have enough money to afford the monthly payments. If you don’t, then you might end up spending more than you can actually pay off.

There is an easy way to determine how much you can spend on your house. The first thing you should do is figure out the amount of the down payment that you want to use. Next, you’ll need to calculate the interest rate.

You can do this by taking the total amount of the loan and dividing it by 12. This will give you the annual percentage rate (APR). Now, multiply the APR by the number of months in the year to get the monthly interest rate.

Once you know the monthly payment, you’ll be able to find out how much you can afford. You should also take into consideration any closing costs that you may incur before you buy a home.

I Make 70000 a Year How Much House Can I Afford

I am a single mother. My husband died 2 years ago. We have a daughter who is 9 months old now. I need to buy a home. I want to get my own place. How much money should I spend on this?

There are many factors that go into determining your affordability. The first thing you will need to do is determine how much you can earn. If you’re currently employed, then you can use the salary calculator to find out exactly what you can expect to be earning.

Once you know what you can expect to make, you’ll need to look at your expenses. You’ll also need to take a close look at your current financial situation. For example, are you paying off any debt? Do you have enough savings to cover the down payment?

If you still don’t feel comfortable buying a home right away, then you may want to consider renting instead. Renting allows you to save up for a larger down payment and gives you more flexibility in your budget.

I Make 36000 a Year How Much House Can I Afford

I’ve been working since I was 14 years old. I have a degree in computer science, but I’m still struggling to pay my bills.

My husband is making more than me, so we’re able to save money, but we don’t know where to start. We need to get into debt free living before we can buy our first home together.

If you’re like me, you want to be happy with your life, but you just don’t understand how you can do it.

There are many ways to live below your means. You should look at all of them. For example, you might try to cut back on unnecessary expenses. Or, you could focus on saving up for a down payment.

You may also consider selling things that you no longer use. This will help you earn extra cash while freeing up space in your home.

And finally, you’ll want to find a way to increase your income. If you can boost your earnings, then you won’t have to rely on credit cards or loans.