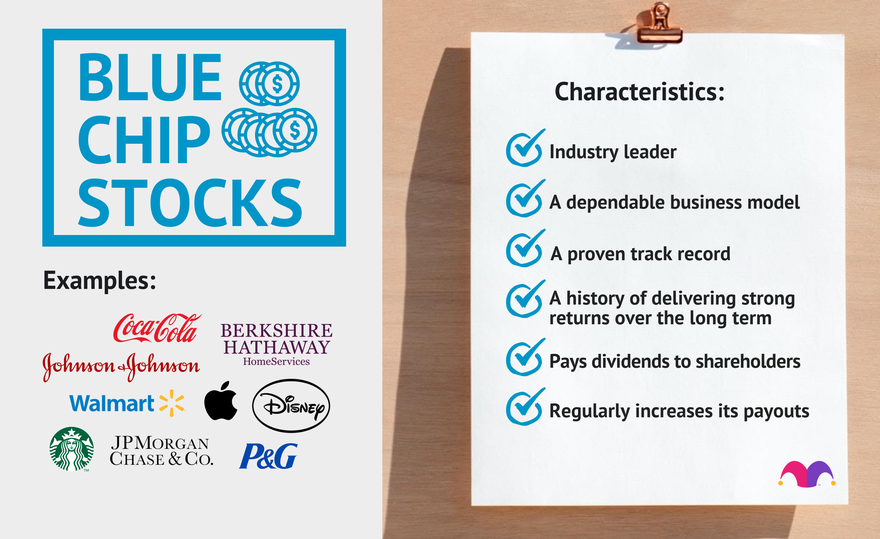

Blue chip stocks are a type of stock that many people invest in. They are considered to be a good investment because they have a good chance of making a lot of money. Listing the characteristics of blue chip stocks is the first step in deciding if you want to invest in them. The next step is to look at some examples of blue chip stocks. After that, we will give you some features to look for when deciding whether or not to buy a blue chip stock.

Which bluechip stock is best?

There is no one-size-fits-all answer to this question, as the best bluechip stocks will vary depending on your individual investment goals and tolerance for risk. However, some of the most popular and respected bluechip stocks include Apple, Coca-Cola, Nike, and Walmart.

Below are three examples of bluechip stocks that could be a good fit for various investor types.

1) Apple Inc. (AAPL) is a well-known tech company that produces iPhone, iPad, and Mac products. The stock has been extremely successful over the past few years and has provided investors with excellent returns.

2) Coca-Cola Co. (KO) manufactures soft drinks and provides consumers with enjoyable brands such as Coke, Sprite, Fanta, Minute Maid, Powerade, and Dr Pepper. The company has a long history of success and is considered one of the world’s leading brands.

3) Nike Inc. (NKE) designs, manufactures, and markets shoes and sportswear internationally. The company’s products are highly sought after by athletes worldwide and have a strong brand name. Nike’s stock has performed very well in recent years and provides investors with high returns on investment

What are 3 companies that have blue-chip stock?

1. Microsoft (MSFT)

2. Coca-Cola (KO)

3. Apple (AAPL)

Each of these companies has a strong balance sheet, robust revenue growth prospects, and a history of providing shareholder value.

Microsoft has been around for over 40 years and has consistently delivered strong financial performance. The company’s flagship product is the Windows operating system, which is used by millions of people around the world.

Coca-Cola has been in business for over 130 years and operates in more than 200 countries. The company’s products include soda, sparkling water, energy drinks, and other food items.

Apple is one of the most valuable companies in the world, with a market value of more than $700 billion. The company produces iPhone, iPad, and Mac products. Apple has a history of delivering strong financial performance and generous dividend payments to shareholders.

Why is it called blue-chip stocks?

The term “blue chip” is actually a portmanteau of the words “blue” and “chip.” The first reference to this term was in the 1920s, when stock prices for blue chip companies were considered to be more stable than other stocks. In the late 1960s, blue chips began to refer specifically to company stocks that were considered to be high-quality, stable investments.

Today, blue chip stocks generally refer to companies that are well-known and have a good reputation. They’re usually large companies with a long history and significant financial resources. Examples of blue chip stocks include Apple, Coca-Cola, Goldman Sachs, and Nike.

Some features that make blue chip stocks attractive investments are their stability and long histories of profitability. Although there is always risk associated with investing in any type of stock, blue chip stocks are typically less volatile than other types of stocks. This makes them a good choice for investors who want to invest in a long-term investment.

If you’re looking for a high-quality investment that will offer you some stability over the long term, consider investing in blue chip stocks.

Is Tata Motors Blue Chip?

Tata Motors is one of the India’s blue chip stocks. Blue chip stocks are companies that have a long history of profitability, stability and growth. They are typically considered to be relatively safe investments with high returns.

Tata Motors has a long history of success. The company was founded in 1918 and has since grown to become one of the largest automotive manufacturers in the world. Tata Motors has consistently achieved high profits and has a strong track record of stability and growth.

In recent years, Tata Motors has developed new products such as the Tigor electric car and the Nano passenger car. These new products have led to increased sales and profits for the company.

Tata Motors is a well-known name in India and around the world, making it an excellent choice for investors. The company has a strong financial foundation and is forecast to continue growing in both sales and profits over the coming years.

Is Tata Steel a blue chip stock?

Tata Steel is one of the oldest and largest steel companies in the world. It operates in a wide range of industries, including iron and steel production, rolling and finishing operations, and infrastructure development. The company has a strong presence in Europe and North America, and its products are used in a variety of industrial applications.

Tata Steel is a leading player in its industry, with a market share of over 30%. It has a strong balance sheet, with net cash and investments of Rs 9,600 crore as of March 2016. This gives Tata Steel flexibility to invest for growth, and support its long-term prospects.

The company’s assets include significant reserves of iron ore and coal, which gives it considerable staying power in the industry. Its diversification into other sectors makes it well-positioned to ride out any economic volatility in the steel sector.

Tata Steel is a blue chip stock because it is well-established and highly profitable, with a strong balance sheet. It has a significant presence in both Europe and North America, providing global reach for investors.

What is the most reliable stock to buy?

There are a few things to consider when trying to answer this question. The most important thing to consider is the company’s track record. A company with a good track record is likely to continue doing well in the future. After looking at the company’s track record, you should also consider its current financial position and how strong its earnings are. Finally, you should look at the stock’s price-to-earnings (P/E) ratio to make sure it is appropriate for your investment goals.

Some of the most reliable blue chip stocks are Intel (INTC), Apple (AAPL), and Microsoft (MSFT). These companies have consistently delivered good results over the past several years, and their stocks are currently priced fairly. Other good blue chip stocks to consider include Coca Cola (KO), Google (GOOGL), and Toyota (TM).

Is Netflix a blue chip stock?

Netflix is a blue chip stock, meaning it is a company with a track record of consistent high performance. The company has consistently delivered strong results and continues to grow at an impressive pace. In fact, Netflix was recently valued at $148 billion, making it one of the most valuable companies in the world.

Some of the features that make Netflix a blue chip stock include its proven ability to grow its revenue and profits, its strong customer base, and its track record of innovation. These factors make Netflix a great investment opportunity, especially given the turbulent market conditions currently affecting many other stocks.

If you’re looking for a company with consistent growth potential and good financial stability, Netflix is a good choice. And since it’s always updating its services, you can be sure that it will keep providing value for years to come.

Is Coca-Cola a blue chip stock?

There is no definitive answer to this question. The term “blue chip” is subjective, and can be defined in many different ways. Some people might say that Coca-Cola is a blue chip stock because it is a well-known and popular company with a long history of success. Other people might define blue chip stocks as companies with strong fundamentals, which means they have a good track record of making money and growing their businesses over time.

Some common blue chip stocks include IBM, McDonald’s, Walmart, and ExxonMobil. These are all firms with a lot of experience, deep pockets, and widespread recognition. They’re also likely to stay afloat during times of economic turbulence – something that’s especially important these days.

If you’re looking for a perfect example of a blue chip stock, look no further than Apple! Apple is one of the most iconic companies in the world, and its products are universally loved. Its business is stable and profitable, and its prospects look strong thanks to rapidly growing emerging markets like China and India. If you’re interested in investing in blue chips, Coca-Cola would be a great place to start!

Is Amazon a blue-chip?

Amazon.com, Inc., commonly referred to as Amazon, is an American electronic commerce and cloud computing company based in Seattle, Washington. The company was founded by Jeff Bezos on July 5, 1994, and he currently holds the title of CEO. As of September 30, 2018, Amazon has a market capitalization of $874 billion and a net worth of $112 billion.

According to the S&P Global Ratings, Amazon is a “Top-Tier” blue chip company with a “AAA” credit rating. This means that the company is considered very stable and has a very low risk of defaulting on its debt obligations. Additionally, Amazon has been given a “A-1+” financial strength rating by Fitch Ratings.

Some common features of blue-chip stocks are that they are large and well-established companies with a long history of successful operations. They typically have strong balance sheets with ample financial resources to continue expanding their businesses and making acquisitions. Finally, blue-chip stocks are usually considered to be very safe investments with consistent earnings and dividend growth over time.

An example of a blue-chip stock is Apple Inc., which is ranked as one of the most valuable publicly traded companies in the

Is Apple blue-chip stock?

Apple is a blue chip stock, which means it has high value and is considered a safe investment. Apple is one of the most valuable companies in the world, with a market capitalization of over $800 billion.

Some of the features that make Apple a blue chip stock are its long history and successful track record. Apple has been around since 1976 and has released numerous successful products, including the iPhone, iPad, and Mac computer. The company’s products are often chosen by consumers as the best in their category.

Apple also maintains a strong balance sheet, with no debt and over $250 billion in cash and investments. This wealth allows the company to grow rapidly and invest in new product lines.

Since Apple is such an iconic company, it is often difficult to find other stocks that are comparable. However, some blue chip stocks that are similar to Apple include Microsoft (MSFT) and Amazon (AMZN). These companies have also been around for many years, have strong balance sheets, and are leaders in their respective industries.

Is blue-chip risky?

Blue chip stock is a term used to describe stocks that are considered to be stable, with a history of producing profits. While some people may see blue chip stocks as a safe investment, others may view them as being too risky.

What is the definition of a blue chip stock?

A blue chip stock is generally defined as a stock that has a long history of producing profits. These companies typically have strong financial stability and are well-known in their respective industries.

Which companies make up the blue chip stock market?

Some of the most well-known blue chip stocks include Apple Inc., Google Inc., Microsoft Corporation, and Coca-Cola Co.

Can blue-chip stocks fail?

Yes, blue chip stocks can fail. In fact, they have failed in the past and they will fail in the future.

What is a blue chip stock?

A blue chip stock is a type of stock that is considered to be a reliable and high-quality investment. These stocks are typically attributed to companies that are well-known and have a good reputation.

Why do blue chip stocks tend to succeed?

Many people believe that blue chip stocks are more stable than other types of stocks. This means that they are less likely to go down in value over time. Additionally, these stocks are often associated with companies that are well-run and have a good reputation. This makes them attractive investments for many people.

How do blue chip stocks fail?

Despite their stability and popularity, blue chip stocks can occasionally fail. This happens when the company behind the stock falls into financial trouble or when there is a significant shift in market conditions. In either case, these stocks can lose a lot of value very quickly.

blue chip stocks india

1. What are blue chip stocks?

Blue chip stocks are stocks that have a long history of profitability and stability. They typically have high levels of investor trust and are considered to be among the safest investments available. these companies typically have a strong competitive position in their respective industries, making them particularly well-suited for long-term investment.

2. What are some examples of blue chip stocks?

Some common examples of blue chip stocks include Apple, Google, Microsoft, and Coca-Cola. Each of these companies has a strong track record of success and is widely recognized for its innovative products and services.

3. What features make blue chip stocks appealing?

Many investors view blue chip stocks as a safe investment option with strong potential for future growth. Additionally, many blue chip stocks are well-known and respected brands that offer a wide range of products and services. As a result, these stocks tend to be more stable than other types of investments and offer better potential for returns over time.

blue chip stocks at 52-week low

Blue chip stocks are a type of stock that is often considered to be a safe investment. This is because blue chip stocks are usually high-quality companies that are not likely to experience major financial challenges.

There are several features that can make blue chip stocks a good investment. First, blue chip stocks are usually well-known and have a long history of success. This means that you can count on them to continue performing well in the future.

Second, blue chip stocks usually have a stable price tag. This means that you will not be able to gain or lose much money by investing in them.

Finally, blue chip stocks are typically easy to trade. This means that you will not have to spend a lot of time researching them before making an investment decision.

blue chip stocks list

What are blue chip stocks?

A blue chip stock is a type of stock that has a reputation for being a quality investment. These stocks typically have high levels of stability and earnings, which make them attractive options for long-term investors.

There are many different types of blue chip stocks, but some of the most common examples include Apple Inc., Exxon Mobil Corp., and Microsoft Corp. These companies have a history of producing consistent profits and outperforming the market, making them ideal investments for those looking for stability and growth.

Why are blue chip stocks so popular?

Many people believe that blue chip stocks offer superior value compared to other types of stocks. This is because these companies tend to have a lot of stability and aren’t as susceptible to volatility or sudden changes in price. They also typically have high levels of earnings, which means they can offer generous payouts to shareholders.

What are some features to look for when investing in blue chip stocks?

Some key features to look for when investing in blue chip stocks include high levels of stability, consistent earnings, and generous payouts to shareholders. It’s important to do your research before making any decisions about these stocks, as not all companies will fit this

blue chip stocks canada

What are blue chip stocks?

A blue chip stock is a type of stock that is considered to be a safe investment, as it has a history of providing consistent returns. These stocks are typically those with large market capitalizations and strong fundamentals.

What are some examples of blue chip stocks?

Some examples of blue chip stocks include Apple Inc. ( AAPL ), Amazon.com Inc. ( AMZN ), and Microsoft Corporation ( MSFT ). These companies have consistently outperformed the broader stock market, providing investors with healthy returns over the long term.

What features make blue chip stocks attractive?

Some features that make blue chip stocks attractive include their high market capitalizations, stable earnings, and sound fundamentals. These stocks typically have a good track record of making money for their shareholders and are unlikely to experience major fluctuations in value.

blue chip stocks philippines

What are blue chip stocks?

A blue chip stock is a type of equity security that is considered to be a high-quality investment. The term “blue chip” comes from the fact that these stocks are typically traded on the exchanges at a higher price than other types of stocks.

Who chooses the blue chip stocks?

The blue chip stocks are typically those with the highest returns and stability over time. They are chosen by professional investors because they believe that these stocks offer the best chance for long-term success.

What are some examples of blue chip stocks?

Some examples of blue chips include Microsoft, Coca Cola, Ford Motor Company, and Procter & Gamble. Each of these companies has a history of consistent profitability and growth.

blue chip stocks malaysia

What are blue chip stocks?

A blue chip stock is a type of security that derives its value from its stable financial performance and its ownership by institutional investors. These stocks typically have a high reputation and are considered to be a safe investment.

What are the features of blue chip stocks?

Some of the features of blue chip stocks include:

-They tend to be more stable than other types of securities, and are therefore less likely to experience price volatility.

-They are often associated with companies with strong fundamentals, meaning they have sound business operations and a good track record.

-They are often highly liquid, meaning they can be easily traded on exchanges. This makes them attractive for investors who want to take advantage of short-term market movements.

-Blue chip stocks tend to be more expensive than other types of securities, but this is offset by their stability and long history of offering good returns.

What are some examples of blue chip stocks?

Some examples of blue chip stocks include Apple Inc., Boeing Co., General Electric Co., Microsoft Corp., Visa Inc., and Wells Fargo & Co.

blue chip stocks singapore

What are blue chip stocks?

Simply put, blue chip stocks are stocks that are considered to be quality investments. They tend to be some of the most reliable and popular stocks on the market, and often have a long history of success. This makes them a good choice for investors who want to stick with stable, high-quality companies.

Which companies make up the blue chip stock market?

Some of the most well-known blue chip stocks include IBM, Coca Cola, and McDonalds. These companies have a long track record of success, and their shares are generally considered to be safe investments. However, there is always the potential for these stocks to go down in value if the company performs poorly.

Why should I consider buying blue chip stocks?

There are a number of reasons why blue chip stocks can be a good investment. Firstly, they tend to be very stable and rarely experience major fluctuations in value. This makes them a good choice for investors who want to stick with a single stock for an extended period of time. Additionally, blue chip stocks are usually well known and respected, which gives them an added level of security.

What are some features of blue chip stocks?

top 10 blue chip stocks

What are blue chip stocks?

A blue chip stock is a type of stock that is associated with high-quality companies. These companies are typically leaders in their fields and have a strong reputation.

Why are blue chip stocks valuable?

Blue chip stocks are valuable because they offer investors a chance to invest in some of the most respected and well-known companies in the world. These companies tend to be very stable, which means that their stock prices are generally resistant to fluctuations. This makes them a good choice for long-term investors.

What are some features of blue chip stocks?

Some features of blue chip stocks include a high degree of liquidity, strong financials, and a strong track record of growth. Each of these factors contributes to the value of a blue chip stock.

dividend blue chip stocks

Blue chip stocks are stocks that have a history of paying dividends. In general, these stocks are considered to be safer investments than other types of stocks, since they are less likely to go out of business.

There is no one definition of a blue chip stock. Generally, a blue chip stock is a company that is well known and has a long history of successfully paying dividends. Some common examples of blue chip stocks include Coca-Cola (KO), IBM (IBM) and Apple (AAPL).

Investment analysts often look for companies that have a strong balance sheet and histories of paying dividends when selecting blue chip stocks. These characteristics make these stocks less risky and more likely to provide returns over the long term.

It is important to note that not all blue chips are created equal. It is important to carefully research each company before investing in them, since not all have the same features or dividend payout potential.

best dividend blue chip stocks

The best dividend blue chip stocks offer investors a high yield and stability. These stocks are typically known for their consistent performance, which makes them good investments over the long term.

Below is a list of some of the best dividend blue chip stocks:

Apple

Bank of America

Netflix

3M

Ford Motor Company

General Motors