In business, one of the most important calculations is cost of goods sold (COGS), which helps you determine your profit and loss. This guide will teach you the definition and formula for COGS, as well as some tips on how to calculate it accurately. By following these steps, you’ll be able to better manage your finances and track your company’s progress.

How do you calculate cost of goods of sold?

If you’re running a business and want to know how much money you’re spending on each item you sell, you need to calculate cost of goods sold (COGS). COGS is the sum total of all the costs involved in producing an article, from the materials used to the labor costs.

There are a few different methods you can use to calculate COGS, but the most common is the break-even analysis. This method calculates how much money your business needs to make after costs are incurred in order to cover your fixed costs (such as rent and depreciation) plus variable costs (such as sales commissions and product manufacturing costs). Once you’ve determined your break-even point, you can use that figure to determine how much profit your business is making.

The formula for calculating COGS is:

COGS = Cost of Materials + Cost of Labor + Cost of Product

What is COGS and its formula?

Cost of goods sold (COGS) is a calculation used to determine a company’s total cost of ownership for the goods it has sold. This includes costs associated with the production and distribution of the product, such as materials, labor, and overhead. The COGS calculation is also used to calculate profit margin.

To calculate COGS, divide total costs incurred in producing a product by the quantity of units sold. For example, if a company sells 100 widgets and spends $2,000 on production costs, its COGS would be $200 per widget.

What is the cost of goods formula?

The cost of goods sold (COGS) formula is a widely used calculation tool in business. It’s used to calculate a company’s total cost of producing and selling its products. The COGS formula takes into account the following four main categories of costs:

1. Raw materials costs

2. Production costs

3. Labor costs

4. Administration and selling expenses

To use the COGS formula, you first have to figure out the total cost of each item produced. This can be done using a variety of methods, including accounting records, supplier quotes, and production logs. Then, you add these costs together to get your total production cost. Next, you subtract the total cost from the sales price of all products to get your gross profit. Finally, you deduct any associated expenses (such as taxes) to get your net profit.

The COGS formula is important because it can help businesses track their overall profitability and identify wasteful spending on production or marketing efforts. In addition, it can help businesses plan future operations by showing how much they need to raise prices to cover increased costs.

What is cost of goods sold Example?

Cost of goods sold is the total cost of the goods that a business sells during a specific time period. This includes the cost of materials, labor, and overhead costs associated with producing the product.

To calculate cost of goods sold, you first need to determine the value of the products sold. To do this, you need to calculate the average price per unit sold and divide that number by the total number of units sold.

For example, if you sell 100 units of product and the average price per unit is $10.00, then your cost of goods sold would be $1000.00.

How do you calculate cost of goods sold on a profit and loss statement?

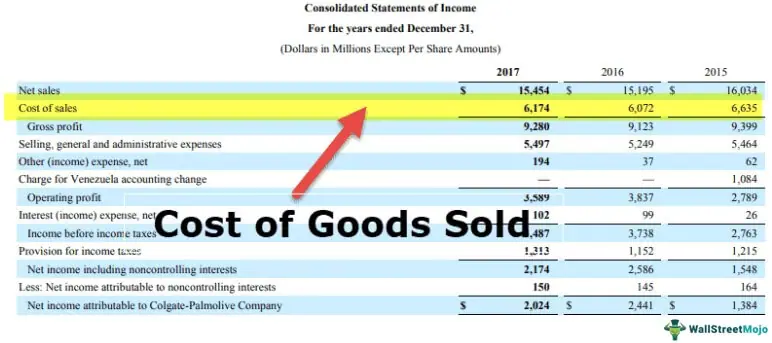

The cost of goods sold (COGS) is one of the most important lines on a profit and loss statement (P&L), because it’s the line where you document how much money you spent on what you sold and how much profit you made. Here’s a quick primer on COGS:

COGS includes all costs associated with selling products, from materials to labor to shipping. In order to calculate COGS, you need to know your sales prices, the cost of goods you purchased, and the quantity sold. Then, you can subtract the cost of goods from the sales price to find your gross margin. Gross margin is a key indicator of your business’ profitability.

Here’s a step-by-step guide on calculating COGS:

1. Calculate your total sales amount by adding up all of your sales figures for the period. This includes both product sales and services rendered.

2. Determine the cost of goods sold (COGS) by multiplying your sales figure by the corresponding cost of goods itemization. This will give you a breakdown of all the different costs associated with your products.

3. Subtract COGS from your total sales figure to get your gross margin

Is cost of sales and COGS the same?

Cost of goods sold (COGS) is a financial measurement that represents the cost of all the items that a company sells in a given period. COGS takes into account both the direct costs of producing an item and any associated indirect costs, such as shipping and handling.

To calculate COGS, you need to know the following:

The unit price of each item sold

The number of items sold

The quantity of each item sold

The cost of producing each item

The cost of shipping and handling for each item

Here’s an example to help understand how it works:

ABC Company produces widgets and sells them for $10 per unit. They sell 10 units in the first month, 20 units in the second month, and 30 units in the third month. The total cost of producing and selling these widgets is $200 ($10 per widget x 10 widgets = 100). The cost of shipping and handling is $5 per widget, so the COGS for these three months would be 150 ($10 + $20 + $30).

How do you calculate COGS from a balance sheet?

When calculating COGS, you will start by looking at the company’s total liabilities and total assets. Liabilities will include accounts payable and other liabilities, while assets will include things like cash and investments.

After liabilities and assets are accounted for, you will subtract inventory from both sides of the equation to get a net worth figure. Next, divide net worth by the number of units sold to get your cost of goods sold (COGS). Finally, subtract taxes from COGS to get your net income figure.