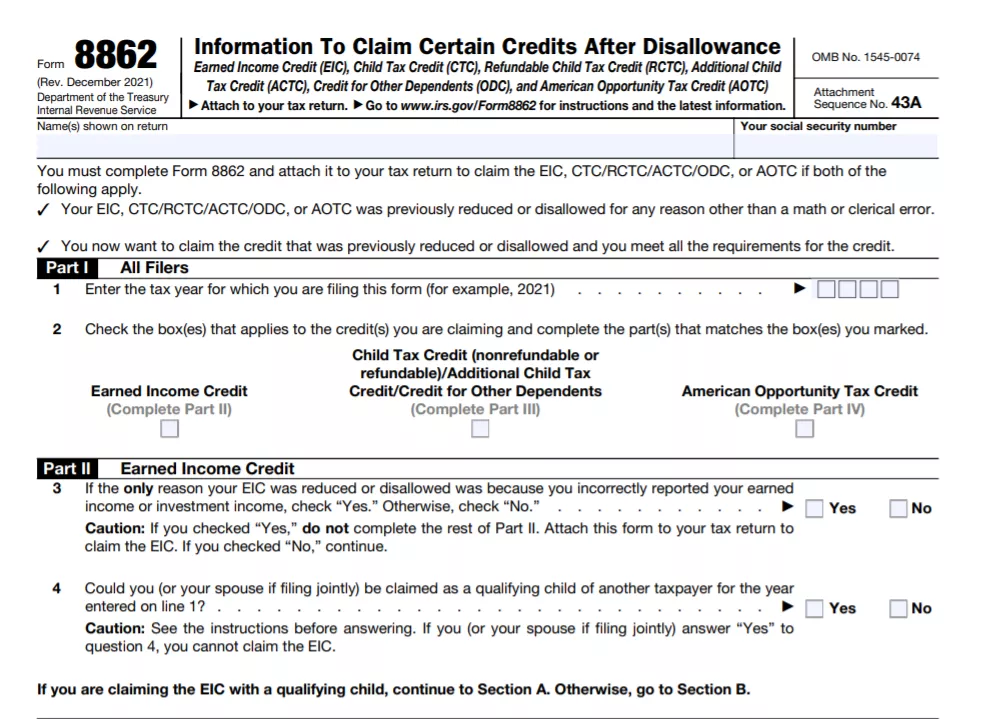

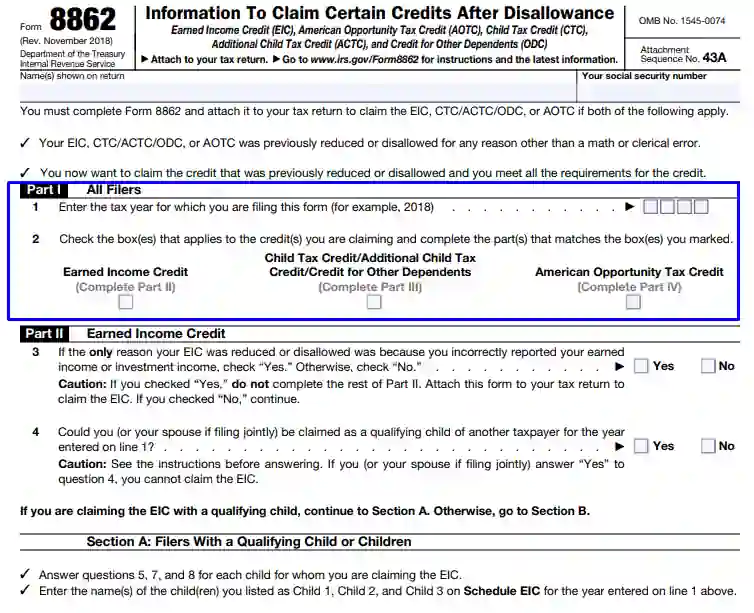

If you’re an American taxpayer, you’re probably familiar with the Tax Form 8862 – a document that reports your income and deductions. But did you know that you have to fill out this form even if you don’t have any income or deductions? In this article, we’ll tell you everything you need to know about filing Tax Form 8862 and claiming your earned income.

What is an 8862 form?

If you are an individual who earned income in 2018, you likely filed Form 1040. But what is Schedule C, and what can you do with it? This full guide will teach you everything you need to know about Schedule C and how to claim your earned income.

If you are self-employed, or if you have partnership or S corporation income, you will most likely file Form 1040A. And if you have qualifying child dependents, you will file Form 1040EZ.

In this full guide, we will explain each of these forms in detail, and we will also provide tips on how to properly file them. We will also provide a full guide on claiming earned income on each form.

So whether you are an individual, a self-employed person, or a business owner, be sure to check out our full guide on filing tax form 8862: information to claim earned income. We hope that this guide will help make the process easier for you!

How do I know if I need Form 8862?

If you are an individual who received wages, tips, or other income in 2018, you may need to file Form 8862, Earned Income Tax Workpapers. This form is used to determine if you are eligible for certain tax credits and deductions.

In this full guide, we will discuss the different types of income that are eligible for Form 8862, as well as the required documentation to support your eligibility. We will also provide a step-by-step guide on how to fill out and file this form.

So whether you are looking to claim a major tax credit or simply want to ensure you are submitting all the correct paperwork, be sure to read our full guide on how to file Form 8862.

Will Form 8862 delay my refund?

If you are an American citizen or resident, you may be able to claim earned income on your tax return. This includes any income that you have earned from working, self-employment, or tips.

To claim this income, you will need to complete a form called Form 8862. This form can delay your refund if it is not correctly completed.

There are a few things that you need to know before completing Form 8862. These include the type of income that you are claiming and the taxes that you owe.

If you have any questions about filing Form 8862, please contact your tax advisor or the IRS. They can help you to complete the form correctly and speed up your refund process.

What does form 8862 look like on TurboTax?

If you are an entrepreneur, self-employed person, or own a business, you may be eligible to claim certain earned income on your federal tax return. This guide will explain the various forms and schedules that must be filed, as well as what you can claim.

Eligible taxpayers can claim earned income from many sources, including salaries, wages, commissions, tips, and taxable self-employment income. This guide covers the main types of earned income: ordinary income, qualified pension income, and capital gains.

This guide also covers the different filing requirements for entrepreneurs and self-employed persons. If you have any questions about claiming earned income on your federal tax return, TurboTax has detailed help available in our product.

What happens if EIC is disallowed?

If you are not eligible for the earned income credit, you may still be able to claim the tax benefit by filling out Form 1040A or 1040EZ. These forms include instructions on how to claim the credit.

If you are disqualified from claiming the EIC because you received income that was generated by a partnership, S corporation, or trust, you may be able to claim the tax benefit by filing Form 1040A or 1040EZ and attaching a Schedule K-1 (Form 1065) to your return. This form includes information on each partner, shareholder, or beneficiary of the trust who earned income during the year.

What does it mean when the IRS disallows a claim?

If you are filing your taxes and you find that the IRS has disallowed a claim that you made on your return, this does not mean that you did anything wrong. The IRS may disallow a claim if it is determined that the expenses that you claimed were not actually earned income.

To understand why the IRS may disallow a claim, it is helpful to know what earned income is. Earned income includes all types of income, including wages, tips, commissions, bonuses, and other types of compensation. In some cases, the IRS may also consider certain types of non-wage income to be earned income. This includes rental income, interest income, and capital gains.

If you find that the IRS has disallowed a claim that you made on your return, do not panic. There are several steps that you can take to try to get the claim approved. First, make sure that you understand why the claim was denied. Second, try to identify any evidence that could support the claim. Third, gather any additional information that might help support the claim. Finally, contact the IRS for advice on how to submit a revised return in order to get the claim approved.

How do I know if I was disallowed EIC?

If you were not allowed EIC because of your filing status, you may be able to claim earned income on your tax return using Form 8938. This form is used to report income that you have earned but were not allowed to include in your income because you are not a U.S. citizen or resident alien.

To qualify for the earned income exclusion (EIC), you must meet certain requirements. First, you must be a U.S. citizen, resident alien, or national of the United States. Second, you must have earned money in the tax year. Third, the wages that you earn must be from personal services performed in the United States.

If you were not allowed EIC because of your filing status, you may be able to claim earned income on your tax return using Form 8938. This form is used to report income that you have earned but were not allowed to include in your income because you are not a U.S. citizen or resident alien. The form includes information about the wages that you have earned and how much of them are qualifying wages. You will need to provide this information on your tax return along with other documentation to prove that the wages are qualifying wages and should be excluded from your

Why do I have to file 8862?

The IRS has created a requirement for all individuals who earn income to file an annual tax return, known as an 8862. This form is used to report any earned income that was over $600 during the previous year.

There are a few exceptions to the 8862 rule, but most people who earn income must file it. If you are unsure whether you have to file the form, please contact the IRS.

Below we provide complete information on what you need to know in order to claim your earned income on your tax return. This includes instructions on filling out the form and more importantly, claiming any deductions or credits that may be applicable.

Why did the IRS deny my child tax credit?

If your child wasn’t able to file their taxes because of a health condition, you may be able to claim them as an income tax dependent. You can also claim your spouse, if they filed taxes on your behalf. There are several requirements that must be met in order for you to claim a dependent, and it’s important that you know about them if you think your child may be eligible.

First, the child must have earned income. This means any income they received from working, getting a scholarship, or any other form of employment. The income doesn’t have to be large – even small amounts can qualify.

Second, the child must have paid taxes on the income. In most cases, this means filing their own taxes and paying any applicable taxes. If the child cannot file their own taxes due to a health condition, you can usually claim them as a tax dependent and pay the taxes for them.

Although claiming a tax dependent can be difficult, it is worth trying if your child meets the qualifications. There are many benefits to claiming a tax dependent, including: increasing the credit limit on your own taxes; reducing your tax liability; and receiving government benefits (like food stamps) on behalf of the dependents

Do I have to pay back Earned Income Credit?

You may be eligible to claim the Earned Income Credit (EIC) if you are working and have income that qualifies. You do not have to repay the EIC if you claim it on your tax return. However, you may want to consider doing so if you have additional income that you can use to reduce your taxes.

The EIC is a credit that helps low-income taxpayers reduce their taxes by providing a percentage of their earned income. The amount of the credit varies based on your income level, but the maximum credit you can receive is $6,318 for 2017.

To qualify for the EIC, your earned income must be less than $50,000 in 2017. You also must have been employed for at least 40 hours during the week of January 1 through December 31 of that year. If you are married filing jointly, your spouse must also have been employed for at least 20 hours during the week of January 1 through December 31 of that year.

If you meet these requirements, claim the EIC on your tax return by filing Form 1040A or 1040EZ. You can also claim the EIC on Form 1040 if you are 65 or older and your modified adjusted gross

How do I get rid of my Earned Income Credit?

If you have income that you earned and did not include on your tax return, you may be able to claim the Earned Income Credit (EIC). The EIC is a credit that you can use to reduce your taxes.

To claim the EIC, you first have to subtract your earned income from your total income. You can do this by using a form called the Taxable Income Worksheet. Then, you can add the EIC amount to your taxable income. This will help you determine how much tax you will owe.

If you are married filing jointly, your spouse may also be able to claim the EIC. Your spouse is defined as your husband, wife, or civil union partner. If you are married filing separately, only you can claim the EIC.

There are some exceptions to the EIC rules. You cannot claim the EIC if:

-Your total income is more than $127,200 ($51,600 if filing single).

-You are self-employed and earn more than $400 in net earnings from self-employment in any quarter of the year.

-You are a nonresident alien who has gross income from U.S. sources

Does EITC add to refund?

If you are eligible for the Earned Income Tax Credit (EITC), you may be able to claim both the EITC and the refund. This article will explain how the EITC works and whether it adds to your refund.

The EITC is a federal tax credit that helps low-income people and families earn money. You can qualify for the EITC if you meet certain income requirements. The most important requirement is that your income is less than $50,000 per year. If your income is more than $50,000 but less than $60,000, you may be able to claim part of the EITC on your taxes. If your income is more than $60,000, you can only claim the entire EITC.

The IRS considers your refundable portion of the EITC when calculating how much money you are expected to receive back in refunds. This means that if you are eligible for the EITC and have already received a refund from the IRS this year, part of the EITC may still be considered as taxable income. However, if you do not have any taxes withheld from your paychecks this year, most of the EITC