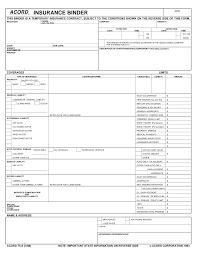

One of the most important documents you’ll ever need when it comes to owning or operating a business is your insurance binder. This document will list all the different types of insurance your business is protected against, as well as the limits of each policy. Our full guide will teach you how to create an insurance binder in record time, so that you can safeguard your business with the right coverage in the event of an accident or sudden loss.

car insurance binder

A car insurance binder is a document that contains all the information you need to file a claim in the event of an accident. This includes your car’s make, model, license plate number, and insurance policy number.

If you’re in an accident and don’t have your car insurance binder with you, you can still file a claim. The police will need to know your vehicle’s make, model, license plate number, and insurance policy number in order to process your claim.

If you have your car insurance binder with you, make sure to save all of the following information:

-The date of the crash

-The location of the crash

-Your vehicle’s make, model, and license plate number

-Your insurance policy number

how to get insurance binder

When you have a new job, it is important to get the right insurance policy. This guide will show you how to get an insurance binder and what should be included in it.

Getting an insurance binder is the first step in getting the right policy. The insurance company will require that you fill out a binder form when you are hired. This form will include your name, address, date of birth, and other vital information. The binder should also include a copy of your driver’s license, social security card, and passport. You should also include copies of your resume and any letters of recommendation.

The next step is to find the right policy. You should look for an affordable policy that covers all of your needs. The policy should also have good coverage for health care, car accidents, and other types of accidents. You may also want to consider adding liability insurance to your policy. This will help cover any personal injury or property damage that you may cause while on the job.

Once you have found the right policy, you need to get a copy of the policy agreement. This agreement will include all of the terms and conditions of the policy. You should also print out a copy of your identification page

insurance binder pdf

Insurance binders are a great way to organize all of your insurance documents and keep everything in one place. Here is a complete guide to creating an insurance binder:

1. Decide what type of binder you need. A three ring binder will hold your printed materials, while a dot matrix binder will hold electronic files.

2. Choose a hard cover book or an online printing provider that offers hardcover printing options.

3. Start by sorting your documents into categories. This could be by company name, policy number, or any other pertinent information.

4. Once your categories are established, begin creating dividers for each category with looseleaf paper or paper clips.

5. Add any pertinent photos or graphics and then close the cover of the binder using thread or binding tape.”

renters insurance binder

What is a renters insurance binder?

A renters insurance binder is a document that contains basic information about your property and the people who will be living there. This document can include things like the address, description of the property, contact information for the landlord and tenants, and more. It’s important to have this document if you’re renting a property, as it can help you protect yourself in case of accidents or emergencies.

allstate insurance binder

Insurance binder definition – a document that includes information about an individual’s insurance policies and coverage. This document is typically used to help individuals keep track of their insurance policies, as well as to help them understand their coverage.

how long does it take to get an insurance binder

Getting an insurance binder can take a few different steps depending on the company you are working with.

The most important step is to schedule a meeting with your insurance agent. They will need to know all of your information, including your current insurance rates, deductible amounts, and other coverage requirements. After the meeting, your agent should give you a starting point for completing your insurance binder.

Once you have your starting point, you will need to gather all of the documentation that relates to your policy. This could include: copies of your current policy, past claims forms, collision reports, and proof of liability insurance.

After you have collected all of the necessary documentation, it is time to start filling in the blanks. Your first step should be to create an overview page that includes:

-Your name and contact information

-Your current insurance rates

-Your deductible amounts

-Coverage requirements for cars, homes, and health insurance

-Other specific information about your policy, such as endorsements or riders

Next, you will need to create pages for each type of coverage. This includes car coverage, home coverage, health insurance, and umbrella policies.

Once you have created each page, it is time

insurance binder georgia

A binder for holding all of your insurance papers is an excellent way to keep everything organized and easy to access. If you are like many people, you probably have a binder that’s full of loose papers that are difficult to find or worse, out of date. Here is a full guide on how to create your own insurance binder.

First, you will need some supplies. You’ll need a binder, some dividers, and some paper clips or staples. You can find these supplies at most office supply stores.

The first step is to divide your binder into sections. You will want to create sections for claims, coverage, medical records, etc. You can also add tabs at the top of each section if you want to keep track of the month, year, or other information related to that particular section.

Now it’s time to start filling your binder! Start by inserting your policies and certificates into the appropriate section. Make sure that each document is properly dated and has the appropriate information associated with it (such as policy number and expiration date).

Next, add any correspondence related to your policies or claims. This could include letters from your insurance company or letters from doctors confirming