If you’re an individual or a small business owner, filing your federal taxes is a must. And if you’re not familiar with Schedule C, now is the time to get up to speed. In this full guide, we’ll walk you through the easy steps of filling out Schedule C and reporting your income. So buckle down, and let’s get started!

What should I put on Schedule C?

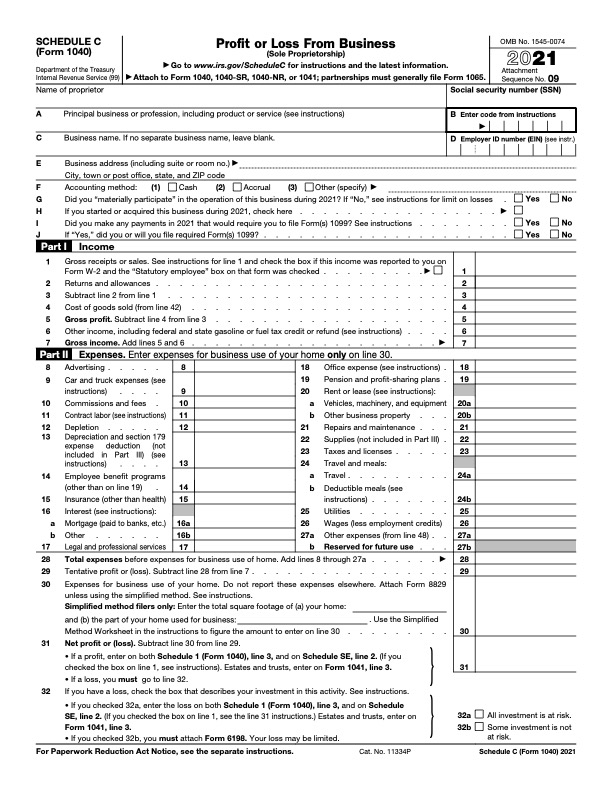

There are a few different things you can put on Schedule C if you are self-employed. You can list your income, expenses, and gains or losses from your business. You can also list any bonuses or other compensation you received from your work.

Here is an easy step-by-step guide on how to fill out Schedule C for your business:

1. List your total income from your business in columns A, B, and C.

2. List all of your expenses related to running your business in columns D, E, and F.

3. Note any gains or losses from running your business in column G.

4. Add up the totals in columns A, B, D, E, and G to get your net profit or loss for the year.

5. If you have a loss for the year, you may want to deduct any allowable business deductions from that loss in step 6 below.

6. If you have a net profit for the year, subtract any allowable business deductions from that net profit in step 7 below.

7. Write “net profit” in column H and click “calculate” to find

What can I deduct on Schedule C?

There are a few things that you can deduct on your Schedule C. These include:

1. Income from self-employment

2. Interest, dividends, and other financial compensation

3. IRA contributions and distributions

4. Expenses for deductible personal reasons

5. Charitable contributions

What can you not deduct on Schedule C?

There are certain things that you cannot deduct on Schedule C, even if they are ordinary and necessary costs of your business. These include:

-Expenses associated with obtaining a business license or registering your business with the government

-Travel costs associated with conducting business

-Legal fees related to your business

-Interest payments on debt used to finance your business

How do I create a Schedule C?

Creating a Schedule C is easy with the help of this full guide. Here are the steps:

1. Open your tax software and click on “File” from the main menu.

2. Select “Create a New File” and enter “Schedule C” in the file name field.

3. Click on “Next.”

4. Select “Single-Owner Business” from the drop-down list and click on “Next.”

5. Type in the information for your business and click on “Finish.”

6. If you’re self-employed, you’ll now need to provide your net profit and loss (unfortunately, this step isn’t covered in this guide). Simply subtract your total expenses from your net profit to get your Schedule C Profit or Loss figure. Remember to keep track of these figures over the course of the year so that you can accurately report them on your taxes!

7. To submit your Schedule C, click on “File” from the main menu and select “Submit a File.” Enter your Schedule C information in the fields provided and click on “Submit.” You’re done!

How much money do you have to make to file a Schedule C?

If you have an income of less than $25,000 per year, you can file a Schedule C with no tax consequences. If your income is between $25,000 and $50,000, you will pay 10% of your income as federal income tax. If your income is over $50,000, you will pay 15% of your income as federal income tax.

How many years can you show a loss on Schedule C?

If you are filing a Schedule C, you can generally show a loss for three years. However, if you have been in business for less than two years and your total income is below $25,000, you can only show a loss for the year you started your business.

What deductions can you claim without receipts?

One of the most common questions people have when filing their taxes is whether they need to keep receipts for all of their deductions. The short answer is that you don’t need to keep receipts for most of your standard deductions, including:

Home mortgage interest paid

Property taxes paid

State and local taxes paid

Medical expenses that are more than 7.5% of your adjusted gross income (AGI)

There are a few exceptions to this rule. You typically need to keep receipts if you itemize your deductions on your tax return, and you need to keep receipts if you are claiming any of the special deductions listed below.

The following are the seven types of deductible items that generally require documentation:

IRA contributions

Casualty losses

Charitable contributions Business rental property depreciation Home office deduction Child tax credit Education credits Rentals over $1,000 in business years Retirement savings contributions

Of these seven, only one (business rental property depreciation) requires keeping receipts if you itemize your deductions. The other six ( IRA contributions, casualty losses, charitable contributions, child tax credit, education credits, and retirement savings contributions) can be claimed without needing any documentation at all

What can I write-off on my taxes as a sole proprietor?

If you are a sole proprietor, you may be able to write off your business expenses on your taxes. This includes things like advertising and software costs. To qualify, your business must generate at least $500 in income during the tax year. Keep in mind that you can only deduct expenses that are actually associated with running your business. This means you can’t deduct things like rent or salaries if they aren’t directly related to running your business.

What can you write-off if you are self-employed?

If you are self-employed, you may be able to write off a portion of your business expenses on your taxes. This is called business expense deduction and it is based on what is known as Schedule C. Here is a quick guide to help you write off your business expenses:

1. Determine your net income (loss). This is the difference between your income and your expenses.

2. Add back any miscellaneous deductions, such as depreciation or mortgage interest payments.

3. Deduct the total of lines 2 and 3 from line 1. That’s your business expense deduction.

4. If you have a net loss, you can carryover any unused business expense deduction for the next year.

Can you deduct cell phone on Schedule C?

If you itemize your deductions on your federal income tax return, you may be able to deduct the cost of your cell phone on Schedule C. Here is a full guide to claiming cell phone deductions on Schedule C:

1. Figure out how much you spent on your cell phone in the year.

2. Add this amount to your other miscellaneous expenses.

3. Multiply this total by 2% (.02) to figure out your deduction.

4. Write this amount down on Schedule C, line 21.

For example, if you spent $2,000 on your cell phone in the year and it was age-appropriate for use, you would write down $200 on Line 21 of Schedule C (or $2,400 if you have more than one). This deduction would reduce your adjusted gross income by $200 and therefore reduce your federal income tax liability by $40 ($200 x 40%).

Do I need to file Schedule C if no income?

If you don’t have any income from your business, you don’t need to file a Schedule C. However, if you have income from your business, you will need to file a Schedule C.

To figure out if you need to file a Schedule C, first determine what type of business you have. If your business is a sole proprietorship, then you only need to file a Schedule C if your gross income from the business is more than $1,500 during the year. If your business is a partnership, LLC, or corporation, then your gross income from the business is generally considered to be your share of the profits earned by the entity during the year.

If your business has income from sources other than sales (such as cash commissions or payments for goods or services not yet delivered), then you will need to figure out how much of that income is attributable to activities within the United States and how much is attributable to activities outside of the United States. Then, you will need to include that amount in your gross income on your Schedule C.