Interesting fact: Simple Interest is calculated by multiplying the Principal amount with a fraction which represents a percentage of interest earned on that principal amount per month. The Principal Amount is also called ‘Debt’. For example: If you borrowed $100 from a bank and pay back 10% annual interest (10%) for 24 months, then you will owe 25$ after those 24 months.

Simple Interest is often confused with compound interest. Compound interest is a fancy name given to the principle that allows an investor to earn more money in return for his initial investment. For instance: if your investments were earning 20% yearly, you would end up owning double of what you invested.

What Is Simple Interest?

To understand this concept, let’s take an easy example. Let’s say you borrow $100 from a friend and pay him 10%.

What Are the Two Formulas for Simple Interest?

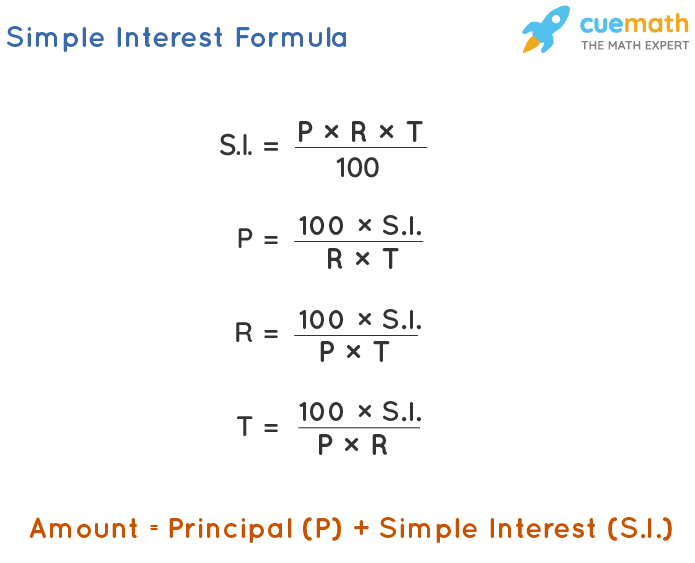

Simple Interest Formula

When you’re talking about compound interest, you need to know how it works. If you don’t understand the math behind compound interest, then you might be wondering why your investments aren’t growing faster than they already have. So here’s the good news. You don’t actually have to worry about the math.

Instead, you just need to learn the basics of simple interest. Here are the two most important things to remember when you want to calculate the growth rate of an investment account.

Interest Rate = the annual percentage yield of the fund divided by 100

Growth Rate = the amount of money in the account today plus the previous year’s balance times the current interest rate

Let’s use a hypothetical example to illustrate this. Let’s say that you invested $100 in a mutual fund that earned 5% per annum. Then, after one year, the value of your original investment was worth $105. Now, let’s assume that you make the same investment every year and earn 2.5%.

What Is Simple Interest Example?

Simple Interest Formula:

When you’re dealing with money, you’ll want to make sure that you understand how compound interest works. This article will explain why this is so important.

It’s true that when you save for the future, you can actually earn more than just the amount of interest. However, if you don’t pay attention to compound interest, you could end up losing a lot of your savings.

In order to calculate the total value of an investment, you need to use the following formula.

I = P * (1 + i)^n

Where:

P – The original price of the investment.

i – The rate of return.

n – How many years you plan to invest.

If you have any questions, you should always check out our website. You can learn all sorts of useful information about investing.

You might also be interested in learning more about the best mutual fund investments that you can find. If you do, then you should definitely take a look at our site. We’ve got some great articles about this topic.

What Is a Simple Interest in Math?

A lot of people have a fear of mathematics. That’s why they don’t like to study it. And that’s why they can get confused when asked to solve a problem.

But, actually, there isn’t anything to be afraid of. Math is just another language. You need to learn how to read, write, and speak the language of mathematics.

Once you’ve learned all of the basics, then you’ll start seeing the beauty of this subject. For example, you might notice that the world around you looks different than it did before you started studying. In fact, you may even realize that you can use mathematical principles to make your life easier.

You should also know that many people who are great at math were once scared of the topic. So, if you want to master the art of solving problems, then you should try to overcome your fears and take a chance on learning more about the subject.

Simple Interest Formula Calculator

If you have ever wondered how much money you need to earn in order to reach a certain goal, then you might be interested in knowing that there is an easy way to calculate this. This article will explain the different methods of calculating your savings goals, so you can use the information to help you decide where to focus your efforts.

There are two basic ways of figuring out how much you should save each month. One method involves using a simple interest formula. The other method requires you to use an amortization schedule. Both of these methods are explained below.

Simple Interest Formula:

This is the easiest way to figure out how much you need to set aside. You just divide the amount that you want to save by 365 days. For example, let’s say that you want to accumulate $1,000 in one year. Then you would multiply that number by 0.15. So, you’d get 1,000 x.15 = 150. If you wanted to save $2,500 per year, then you would multiply 2,500 by the same rate.

Simple Interest Formula in Excel

Simple Interest Formula Excel – A Simple Interest Calculator that Calculates the Rate of Return on Investments.

This calculator will help you calculate the rate of return on investments, such as stocks, bonds, mutual funds, etc. The result is displayed on the bottom right corner of the screen.

In addition to calculating the annualized rate of return, the tool also calculates how many years it takes for your investment to double. This information can be very useful when you are trying to decide whether it makes sense to invest in a particular stock or fund.

If you have any questions, comments, or suggestions please let me know. I hope you enjoy using this free online tool. Please share it with your friends.

How To Make Money On YouTube For Free | How to Earn $100 Per Day on Youtube

★☆★BONUS FOR A LIMITED TIME: ★☆★

GET 25% OFF YOUTUBE COURSE AND GIVE THE GIFTED LIFE MORE VALUE! ► http://giftedlife.co/yt-course

►Website : https://www.

Simple Interest Formula in Hindi

Simple Interest Formula: And Simple Interest Formula in Hindi

When you borrow money, you have to pay back a certain amount of interest. This is how the bank makes its profit. The more you owe, the higher the rate of interest. So, the bigger your debt, the higher the percentage that you will be paying in interest.

If you want to calculate the total cost of borrowing, you need to add the principal and the interest together.

This is where the concept of compound interest comes into play. Compound interest means that the interest you pay on an outstanding balance grows at a faster rate than the original loan.

So, let’s say that you borrowed $1,000, and you paid 10% in interest. If this was compounded every month, then after one year, your loan would have grown to $2,100. After two years, it would have reached $3,200. After three years, the amount owed would be $4,400.

Simple Interest Formula Example with Solution

If you want to learn more about the topic of compound interest, you should take a look at the article below. This is a guide that explains how compound interest works, and why it’s important for your financial situation.

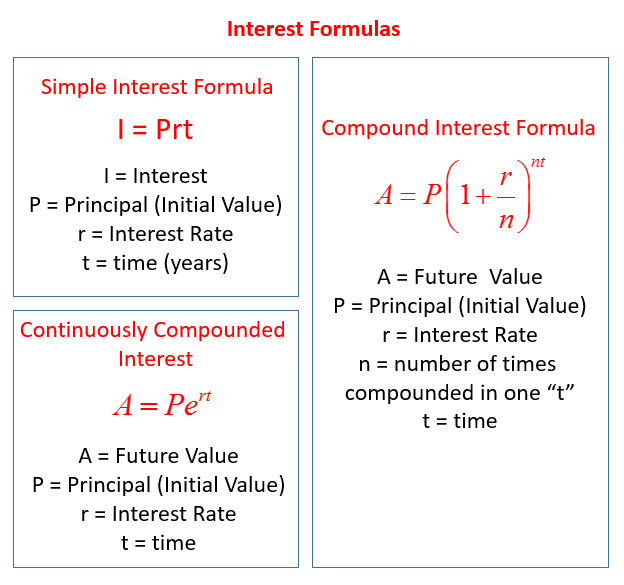

Compound Interest Formula

There are two ways in which people can earn money. One way involves saving up for the future, while another method allows you to spend your money on today. The latter option usually leads to greater returns, but it also requires a lot of effort. If you don’t have enough savings, then you might be interested in learning about the concept of compound interest.

Here is an example of a person who earns $100 per month and saves 10% of that amount. After one year, this individual will end up with $110 after paying all of their expenses. However, if they decide to invest that same amount, then they’ll get back $120 when the time comes. That means that the person has earned an extra $10 through the use of compound interest.

Simple Interest Formula Class 8

This article is a guide for you to understand how to calculate compound interest. Compound interest is a type of interest that adds together all of the previous amounts of money. So, if you deposit $100 into your account, you would earn 5% interest on each of the first three months. If you deposited another $100, you would be earning 10% interest.

However, the most important thing to know when calculating compound interest is to make sure you don’t double count. For example, you should add the amount of money that you have at the beginning of the month to the total that you earned throughout the entire year. This means that you need to take the starting balance of the bank, and then add up everything that you made in a given period.

You also want to keep track of the date that you started making deposits. You can do this by writing down the day and month that you started depositing your money.

Simple Interest Formula and Compound Interest Formula

In order to understand how to calculate your mortgage payment, you need to know the basics of both simple and compound interest.

Simple Interest

This is the most basic form of interest. If you have $1,000 in a savings account, you will earn 2% per year. This means that you would make $20 over the course of one year. Simple interest works by taking the principal amount (the original amount) and dividing it by the number of periods.

Compound Interest

When you use this method, you are actually earning more money than you did with the previous example. For instance, let’s say that you had the same amount of money in a savings account, but instead of earning 2%, you earned 5%. You can easily figure out that you’ll be making $10 after a year.

You might wonder why you should choose to pay off your home early. After all, it seems like it will cost you more money. However, if you don’t do this, then you could end up paying much higher rates of interest.

Simple Interest Formula in Python

This article will teach you how to calculate the compound annual growth rate (CAGR) using Python. This is a very useful tool that will help you determine whether a company will grow at a steady pace.

You can use this method to analyze any type of data, including stock prices, real estate values, and so on. The CAGR calculation allows you to compare the performance of different companies over time.

Here’s How To Calculate Simple Interest Using Python.

1. Import the module.

2. Create an empty list.

3. Add the start and end dates.

4. Loop through each year.

5. Compute the yearly return.

6. Multiply by 100 to get the percentage increase in value.

7. Divide by the original amount.

8. Print the result.

9. Repeat steps 4-8 until all years have been calculated.

10. Plot the results.

Simple Interest Formula Class 7

If you’re looking for a way to earn money while you study, then you might want to take advantage of the simple interest formula. This is a method that allows you to calculate your earnings using a few different formulas.

You should be aware of how much you need to pay each month, so that you know exactly what you’ll have to spend. You will also need to figure out whether you need to save up for any expenses. If you do decide to use this type of calculator, you can expect to make some mistakes. However, it’s important to learn from them.

As soon as you start working with the simple interest formula, you’ll notice that it takes into account the number of months that you plan to invest. The amount that you’re earning is based on the total number of payments that you’re making.

This means that you won’t receive the same rate of return every time. However, you will still get a good idea of what you’re likely to earn.